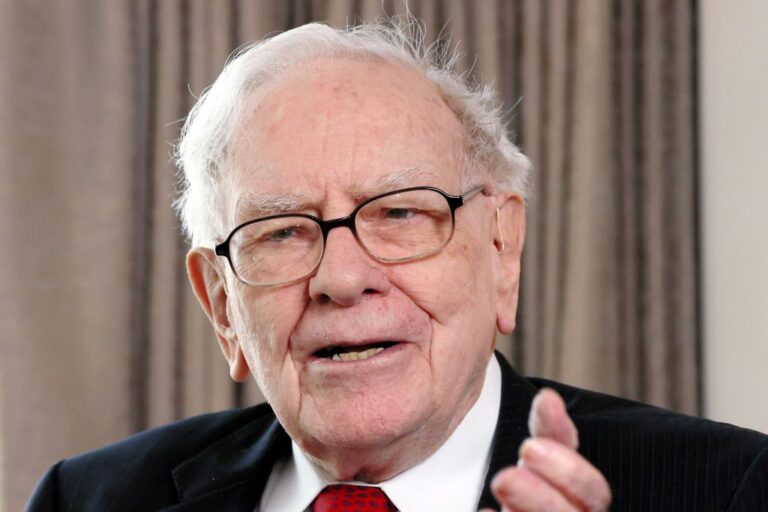

When a CEO is in his nineties, you’d assume buyers would not be caught off guard when he says it is time to cling it up. However Mr. Market appears to be displeased by Warren Buffett’s announcement in Could that he would hand over the reins at Berkshire Hathaway (BRK.B) on the finish of 2025. (Buffett, who turned 95 on August 30, will stay as chairman.)

Since that day, Berkshire’s “B” shares have fallen 12.6% — even because the broader market notched new highs, with the S&P 500 Index returning 11.8%. (Costs and returns are as of July 31, until in any other case famous.)

Chances are you’ll be questioning if there’s an alternative choice to a post-Buffett Berkshire. A couple of Berkshire Hathaway clones are in the marketplace — companies with insurance coverage at their core and portfolios of companies and shares constructed for long-term returns. Some funds both explicitly or implicitly comply with the Warren Buffett manner.

From simply $107.88 $24.99 for Kiplinger Private Finance

Be a better, higher knowledgeable investor.

CLICK FOR FREE ISSUE

Join Kiplinger’s Free Newsletters

Revenue and prosper with one of the best of skilled recommendation on investing, taxes, retirement, private finance and extra – straight to your e-mail.

Revenue and prosper with one of the best of skilled recommendation – straight to your e-mail.

We checked out a few of the choices beneath. Truthful warning: Changing Buffett could also be as troublesome in your portfolio as it’s for Berkshire.

Little or no of the Berkshire transition was a shock. Buffett has had stock-picking assist for a while from Berkshire execs Ted Weschler and Todd Combs.

And Greg Abel, the person Buffett tapped as the subsequent CEO, was first named a possible successor in January 2018. However Abel constructed his profession as an power govt, not a portfolio builder.

That appears to have spooked Buffett acolytes, who wonder if Berkshire’s magical long-run returns — a compounded 19.9% from 1965 by 2024 — can proceed.

“Buffett is ready to take his big stability sheets and switch $1 into $2,” says Vitaliy Katsenelson, a cash supervisor and creator of The Mental Investor. “I do not know the way good Greg Abel is.”

That sums up the uncertainty. However Buffett boosters counsel shareholders ought to stay affected person.

Christopher Bloomstran, a St. Louis–primarily based cash supervisor, doesn’t consider the stalled inventory value “has something to do with the chance that Greg isn’t going to do a bang-up job. I feel he’ll. I feel he is completely phenomenal.”

Buffett’s Canadian counterpart

Although Abel was born in Alberta, the person broadly referred to as “the Canadian Warren Buffett” is 75-year-old Prem Watsa, who based insurer Fairfax Monetary (FRFHF) in 1985 and serves as its chairman and CEO.

The inventory trades over-the-counter within the U.S., and on the Toronto Inventory Trade (FFH), accessible through some brokers, together with Constancy, Interactive Brokers and Schwab. In both case, prices could apply.

With a $39 billion market worth, Watsa’s firm has developed an identical — albeit smaller — following to Berkshire’s. The Fairfax annual assembly is a multiday affair that draws value-oriented buyers from Canada and different international locations.

A fan weblog, the Nook of Berkshire & Fairfax, is devoted to worth investing boards and dialogue of the similarities between the 2 corporations.

Fairfax’s outcomes counsel why: The corporate’s guide worth per share elevated a median 18.7% per 12 months from 1985 to 2024, whereas the share value elevated at an annualized charge of 19.2%.

Watsa could also be much more of a discount hunter than Berkshire, and that has often led to selecting losers. Fairfax’s portfolio has muddled alongside for years with a big place in BlackBerry (BB), the mobile-phone pioneer that has struggled to reinvent itself.

Fairfax has had some winners not too long ago, although. A big place in Canadian steelmaker Stelco paid off handsomely when Cleveland-Cliffs (CLF) purchased the corporate in 2024. Fairfax’s one-third stake in Greece’s Eurobank elevated in worth from $2.3 billion on the finish of 2023 to $3.2 billion on March 31.

Stephen Boland, an analyst at brokerage Raymond James, says Fairfax is likely one of the most diversified insurers, each within the variety of international locations wherein it operates and within the traces of insurance coverage it sells.

The corporate is “nonetheless uncovered to California wildfires — it took a giant loss for that in 2024 — but it surely has tended to diversify the enterprise actually, rather well on the insurance coverage aspect,” says Boland, who recommends the shares.

With what he believes was a “stellar” second quarter for the corporate’s funding portfolio, the inventory is his high decide within the Canadian insurance coverage sector. It trades at about 10 occasions earnings for the 12 months forward, in accordance with S&P World Market Intelligence.

Berkshire Hathaway’s insurance coverage operations largely goal customers — its Geico subsidiary causes some analysts to categorize Berkshire as an auto insurer.

Markel (MKL), in contrast, is a “specialty insurer,” with subtle clients. It sells merchandise similar to collectible-car insurance coverage, legal responsibility insurance policies for company boards of administrators, and insurance coverage towards injury to offshore oil rigs.

Like Fairfax, Markel has inspired comparisons to Berkshire. For 35 years, the corporate, headquartered in Virginia, has held a brunch in Omaha on the weekend of the massive Buffett bash. Greater than 2,500 folks reportedly attended the 2025 occasion.

Over the previous 38 years, the corporate’s share value has elevated at an annualized charge of roughly 15%.

Berkshire inventory is the only largest holding in Markel’s portfolio, accounting for $1.7 billion price of property on March 31 — thrice the scale of the second-largest place. Alphabet (GOOGL), Brookfield (BN), Deere (DE) and Amazon.com (AMZN) spherical out the highest 5, with every place price about $400 million to $500 million.

Markel’s portfolio of shares, like Berkshire’s, accounts for a heavier proportion of property than for many insurers, which are inclined to give attention to bonds. A separate division, Markel Ventures, holds 100% possession in 20 corporations, a lot of that are producers.

Analysts say they like Markel in the long term, however a latest spike within the shares, coupled with underwhelming insurance coverage outcomes, has cooled them on its near-term efficiency.

Activist investor Jana Companions disclosed in December 2024 it had taken a stake in Markel and wished the corporate to spin off its ventures unit in order that it could be a extra enticing takeover goal for a traditional insurer.

The Jana information boosted Markel’s inventory value, and it trades at about 20 occasions earnings for the 12 months forward, in accordance with S&P. Simply considered one of seven analysts who cowl Markel charge it a Purchase.

Given depressed income, “I feel they’re buying and selling sort of the place they need to be now,” says analyst Robert Farnam, of funding agency Janney, who has a Maintain ranking on the shares.

However the inventory could have enchantment for buyers who purchase on dips or who’ve a protracted sufficient time horizon. “I take into account Markel to be a terrific long-term funding,” says Farnam. “That is the kind of inventory that you simply mainly put into retirement accounts and neglect about.”

Loews (L) has an insurance coverage firm at its core and owns a number of companies, together with motels and an power pipeline firm, so it, too, has drawn comparisons to Berkshire. However in some ways, Loews is extra of a household conglomerate.

Benjamin Tisch, named CEO this 12 months, is the third era of his household to run the corporate, a part of the S&P 500, and members of the Tisch household personal roughly 20% of the inventory.

“Despite the fact that Loews is within the 500, there’s low investor curiosity” due to the Tisches’ outsize stake, says Catherine Seifert, an analyst with CFRA who stopped protecting the corporate greater than two years in the past. “And so they’re not as diversified as Berkshire anyway. Actually, if you wish to replicate Berkshire, you are in all probability higher off doing it with a collection of exchange-traded funds.”

Following Buffett’s path

There are a handful of ETFs that explicitly comply with Berkshire; however with the Buffett premium seemingly dissipating at Berkshire, you may be higher off in search of different funds that incorporate Buffett-esque investing ideas, such these centered on corporations that take pleasure in large “moats,” says Aniket Ullal, head of ETF analysis and analytics at CFRA.

When Buffett explains his need to spend money on companies with a long-term aggressive benefit, he has lengthy used the phrase moat, as in a waterway that surrounded castles of the Center Ages.

A moat retains potential rivals away from your enterprise — in financial phrases, it is referred to as a barrier to entry. Berkshire’s wholly owned subsidiary BNSF Railway, for instance, has a moat: Solely 4 main railroad corporations stay within the U.S., and the likelihood {that a} new one will attempt to lay hundreds of miles of monitor to compete is almost zero.

The biggest and oldest moat ETF is the VanEck Morningstar Large Moat ETF (MOAT), which tracks the Morningstar Large Moat Focus Index. The 52 corporations within the index as of Could 31 had been the most cost effective of what Morningstar considers wide-moat shares, primarily based on their low cost to the analysis agency’s estimate of their truthful worth.

The ETF’s high three holdings finally report had been Estée Lauder (EL), navy shipbuilder Huntington Ingalls Industries (HII) and Allegion (ALLE), an industrial safety agency.

In contrast with related funds, the portfolio is chubby in well being care and shopper staples shares and has much less invested in shopper discretionary and monetary companies names, in accordance with Morningstar.

In a market that has seen years of exuberance for high-growth names, nevertheless, the fund’s philosophy has had a blended monitor document. It returned 7.5% over the previous 12 months, in contrast with 16.3% for the S&P 500.

4 occasions prior to now decade, it has been within the high 6% of its fund class (U.S. large-company shares with a mix of progress and worth traits). But it surely had a poor 2024, rating within the backside 5%. The fund’s expense ratio is 0.47%.

One other method is to zero in on funds that target metrics that usually level to the sort of high-quality corporations that Buffett favors.

We want the JPMorgan U.S. High quality Issue ETF (JQUA), a member of the Kiplinger ETF 20, the listing of our favourite exchange-traded funds. The fund tracks an index that sifts for corporations that meet 10 standards, together with measures of profitability similar to robust earnings and money circulation; monetary threat (low debt, excessive curiosity protection, low share-price volatility); and earnings high quality (constant accounting practices).

It has returned 13.6% over the previous 12 months, and its 0.12% expense ratio makes it one of many least expensive funds of its variety. High sectors are know-how, monetary companies and shopper discretionary shares. Nvidia (NVDA) was the fund’s high holding finally report. Berkshire Hathaway locations within the fund’s high 10.

Then once more, maybe you need to comply with Buffett’s personal funding recommendation for particular person buyers. In 1994, he instructed shareholders that by “periodically investing in an index fund, a know-nothing investor can really outperform most funding professionals.”

At Berkshire’s 2020 annual assembly, he elaborated: “In my opinion, for most individuals, one of the best factor to do is to personal the S&P 500 index fund. Folks will attempt to promote you different issues as a result of there’s more cash in it in the event that they do.” He has particularly prompt the low-cost Vanguard S&P 500 ETF (VOO), with an expense ratio of 0.03%.

Word: This merchandise first appeared in Kiplinger Private Finance Journal, a month-to-month, reliable supply of recommendation and steering. Subscribe that will help you earn more money and maintain extra of the cash you make right here.

Associated content material

TOPICS

Warren Buffett

Berkshire Hathaway