Key Takeaways

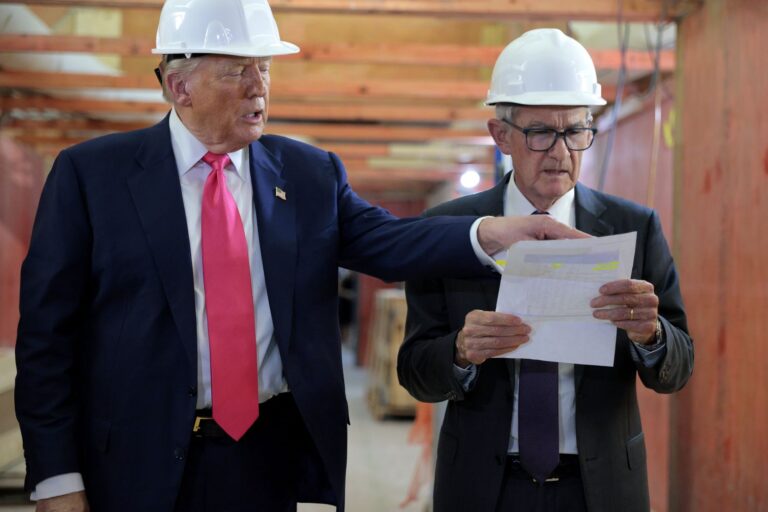

- President Donald Trump has pressured the Federal Reserve to decrease its benchmark rate of interest, saying doing so would assist push down mortgage charges and curiosity the U.S. pays on its nationwide debt.

- Mortgage charges are tied to inflation expectations, which might really rise if traders imagine the Fed is decreasing its price for political causes.

- The federal government’s long-term borrowing prices have solely elevated because the final time the Fed lower rates of interest, casting doubt on the concept chopping the fed funds price would assist the federal funds.

President Donald Trump’s efforts to stress the Federal Reserve into decreasing its benchmark rate of interest might end in greater borrowing prices for homebuyers and the federal authorities, consultants say.

Since he took workplace, Trump has pushed the central financial institution to chop its key fed funds price, which it has held at a higher-than-usual degree all yr in an effort to quell inflation. Trump has blamed the excessive fed funds price for holding rates of interest elevated on the U.S. nationwide debt, placing the federal government’s funds farther into the purple than it in any other case can be, and for holding charges on mortgages excessive, pushing homebuying prices out of attain for hundreds of thousands.

Nonetheless, economists imagine that his tried answer might make each issues worse. This is how Trump’s push to decrease charges might have the alternative of its meant impact.

The Fed Solely Controls Quick-Time period Curiosity Charges

The Federal Reserve units the fed funds price, which determines the rates of interest banks pay to borrow cash from each other in a single day. Every kind of different loans are tied to the fed funds price, together with bank cards and automotive loans.

Charges for 30-year mortgages, nevertheless, aren’t immediately linked to the fed funds price. As an alternative, they’re tied to yields on 10-year Treasury notes issued by the U.S. authorities. These yields are set by monetary markets as merchants purchase and promote treasuries, with costs fluctuating primarily based on how traders assess the dangers concerned. Inflation expectations closely affect the yields: Typically, the upper the inflation forecast is for the longer term, the upper the yields go on 10-year Treasurys.

“If the market smells rising inflation, it should push long-term rates of interest greater and never decrease,” mentioned Jon Hilsenrath, senior advisor at monetary companies firm StoneX.

In different phrases, if monetary markets anticipate greater inflation sooner or later, mortgage charges are prone to rise.

Many consultants have raised this concern, together with employees on the Nationwide Affiliation of Mortgage Underwriters.

“A hasty or ill-timed price lower, particularly one perceived as politically motivated, might do extra hurt than good—elevating long-term borrowing prices, undermining monetary confidence, and complicating the trail to sustained financial progress,” the group wrote in an unsigned web site put up in April.

Trump Threatens The Fed’s Independence

The Federal Reserve is the establishment answerable for holding inflation underneath management, and its essential instrument for doing so is the fed funds price. When inflation is just too excessive, the fed raises the fed funds price, pushing up borrowing prices on short-term loans, slowing the financial system and permitting provide and demand to rebalance. That is what it did beginning in 2022 through the post-pandemic surge of inflation.

The extra traders imagine the Fed will succeed at holding inflation operating at its goal of a 2% annual price, the decrease charges shall be on long-term loans. But when individuals lose religion that the Fed will preserve inflation underneath management, these charges might rise.

Even earlier than Trump was elected, economists sounded the alarm that Trump’s stress on the Fed to decrease rates of interest might cut back its independence and, subsequently, its credibility. These issues have solely grown as Trump’s rate-cut stress has intensified, most not too long ago together with his dismissal of Fed Governor Lisa Cook dinner.

“Individuals are paying too excessive an rate of interest,” Trump mentioned this month in a cupboard assembly. “That is the one drawback with housing. We have now to get the charges down a bit of bit.”

Each ideological allies and opponents of Trump have raised issues concerning the Fed’s independence, together with Michael R. Pressure, director of coverage research on the conservative American Enterprise Institute assume tank.

“Eroding central financial institution independence will make traders, companies, and households much less assured that the Fed will be capable of preserve inflation low and steady as a result of they’ll anticipate that the president will be capable of bully the Fed into holding rates of interest decrease than is merited, juicing demand and creating inflationary stress,” Pressure wrote in August. “Larger anticipated future inflation will put upward stress on lengthy charges.”

What Occurred Final Time The Fed Reduce Charges?

Latest expertise casts doubt on the concept a decrease fed funds price would push down long-term borrowing prices. In late 2024, the Fed lower its benchmark rate of interest by a complete proportion level over the course of 4 months, at a time when it appeared like inflation was lastly simmering all the way down to the Fed’s objective.

Since then, yields on 10-year Treasurys and mortgage charges have hovered across the identical vary. Yields on 30-year Treasury bonds, which mirror investor issues about inflation and the federal government’s capacity to pay its money owed, have neared 5% in current days, a degree not seen since 2006. That is particularly problematic for the federal funds because the Treasury Division is the one paying curiosity on these bonds.

Future price cuts might even have the alternative of the specified impact, particularly if markets imagine the Fed is making the cuts for political causes.

“The President may get what he desires and get a a lot decrease short-term rate of interest,” Hilsenrath mentioned. “However long-term rates of interest on federal authorities debt might improve.”