Momentum could possibly be constructing within the semiconductor gear sector.

Utilized Supplies (AMAT 3.08%) was amongst a number of semiconductor gear corporations to achieve final month, as the corporate, recognized for making gear to supply chips and show panels, benefited from a number of macroeconomic and sector-level information gadgets final month.

Whereas there was no main company-specific information out on Utilized Supplies final month, the associated gadgets had been sufficient to drive the top off 27%, in keeping with knowledge from S&P World Market Intelligence.

As you may see from the chart, a lot of the positive aspects got here in the midst of the month.

AMAT knowledge by YCharts

A brand new semiconductor growth

Whereas the bogus intelligence (AI) growth has propelled shares like Nvidia to multibagger positive aspects, the semiconductor gear sector, which operates on a unique cycle, has lagged behind on account of weaker progress and challenges in areas like China.

Nonetheless, buyers responded positively to information out of the sector final month, indicating {that a} new spending cycle could possibly be afoot in semiconductor gear.

First, Utilized Supplies benefited from the Federal Reserve’s 25-basis level price minimize on Sept. 17, and its forecast for 2 extra cuts over the remainder of the yr. Semiconductor gear, corresponding to what Utilized Supplies sells, tends to be very costly, so decrease charges ought to make it simpler for the corporate to borrow cash to allow them to purchase merchandise from Utilized Supplies. The inventory gained 2.6% that day.

Utilized Supplies then jumped the next session after Nvidia and Intel introduced their partnership. The transfer helped enhance Utilized Supplies and its semi gear friends, since Intel is a significant fab, and Nvidia’s $5 billion funding into Intel was anticipated to gasoline spending on chip gear. It additionally improves Intel’s prospects over the long run. The inventory jumped 6.5% that day. Utilized Supplies is a significant provider for Intel, and even obtained Intel’s EPIC Provider Award this yr.

Lastly, Utilized Supplies jumped 5.4% on Sept. 22 after it obtained an improve to chubby from Morgan Stanley. The funding financial institution hiked its wafer fab gear gross sales progress forecast from 5% to 10%, seeing elevated demand in reminiscence. Consequently, it boosted EPS estimates for Utilized Supplies.

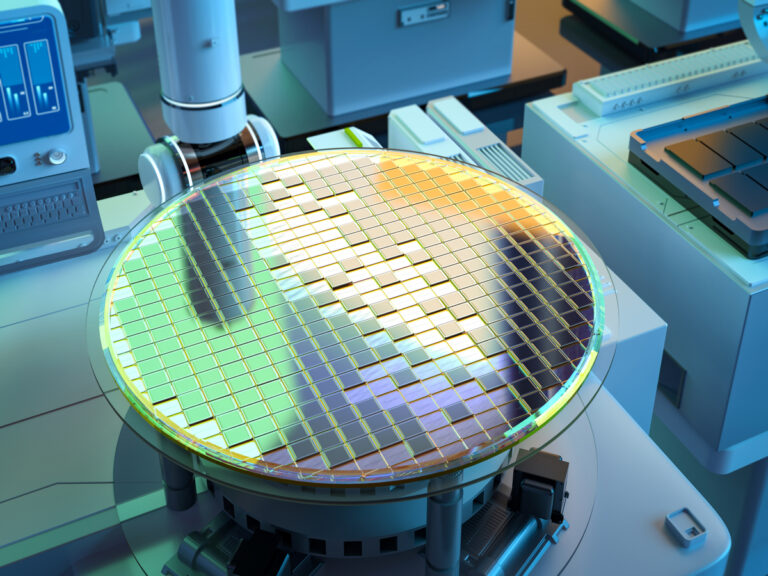

Picture supply: Getty Pictures.

What’s subsequent for Utilized Supplies?

A robust earnings report from Micron towards the top of the month additionally appeared to spice up Utilized’s prospects.

Like ASML, Utilized Supplies’ enterprise energy hasn’t been in query, however cyclical demand is a significant component, as income rose simply 8% in its most up-to-date quarter.

Nonetheless, the information round Intel and broader progress in AI is promising. If that momentum continues, Utilized Supplies has room to maneuver larger.

Jeremy Bowman has positions in ASML, Superior Micro Units, Micron Expertise, and Nvidia. The Motley Idiot has positions in and recommends ASML, Superior Micro Units, Utilized Supplies, Intel, and Nvidia. The Motley Idiot recommends the next choices: quick November 2025 $21 places on Intel. The Motley Idiot has a disclosure coverage.