Key Takeaways

- President Donald Trump and Chinese language president Xi Jinping are set to fulfill in South Korea Thursday and hammer out a commerce deal.

- The 2 nations have tentatively agreed on a framework that might defuse threats of upper tariffs and export restrictions that each nations have made in latest months.

- The deal is more likely to signify a de-escalation of the commerce conflict, however not settle it fully.

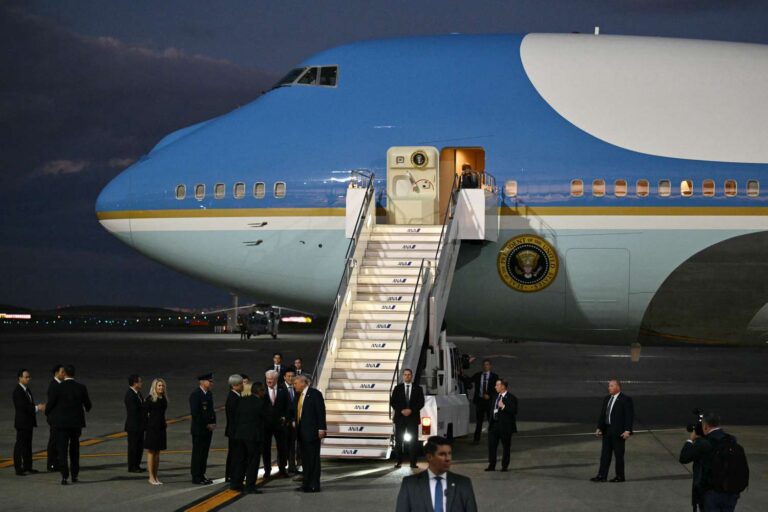

Upcoming talks between President Donald Trump and Chinese language president Xi Jinping may defuse a number of main financial flashpoints within the commerce conflict between the 2 nations.

The leaders of the world’s two largest economies are anticipated to fulfill Thursday in South Korea to barter a number of disputed points which have threatened each nations in latest months. The leaders will hammer out particulars of an settlement on tariffs, soybeans, uncommon earth minerals, and fentanyl, Treasury Secretary Scott Bessent stated in tv interviews this weekend, following his personal conferences along with his Chinese language counterpart.

“I imagine that we’ve got the framework for the 2 leaders to have a really productive assembly for each side,” Bessent stated on Meet The Press Sunday. “And I feel will probably be improbable for U.S. residents, for U.S. farmers, and for our nation typically.”

What This Means For The Financial system

Thursday’s commerce talks could possibly be a giant step towards de-escalating financial tensions between the world’s two strongest counties.

Ought to the negotiations play out as Bessent indicated, they’d alleviate a number of financial threats which have emerged in latest months because the U.S. and China have imposed tit-for-tat commerce measures in opposition to each other. Shares rose Monday on optimism that the latest commerce wars would de-escalate.

Commerce tensions had significantly escalated earlier this month after Chinese language officers stated they’d prohibit exports of uncommon earth minerals, that are utilized by high-tech industries everywhere in the world, together with the U.S. The minerals are essential to make batteries, laptop chips, and weapons amongst different merchandise. Trump retaliated by threatening to impose triple-digit tariffs on China, on prime of already excessive import taxes, probably driving up prices for U.S. customers and inflicting shortages of shopper merchandise.

The additional tariffs are actually probably “off the desk,” Bessent stated on Face The Nation. He additionally stated he expects China to difficulty “some sort of deferral” on its uncommon earth export controls.

In one other signal of progress, Scott stated China would probably resume shopping for soybeans from the U.S., probably reinstating the primary buyer for U.S. soy farmers after China halted all purchases earlier this yr. China can also take motion to scale back fentanyl smuggling to the U.S., which may pave the best way for Trump to take away the 20% tariff he had imposed to crack down on the stream of illicit medication.

General, the talks may assist cool the on-again, off-again commerce conflict between the U.S. and China that flared up this yr as Trump has sought to remake U.S. commerce coverage. Nonetheless, some specialists stated the talks have been unlikely to settle underlying variations that drive the battle, together with the American commerce deficit with China that Trump has steadily criticized, and American reliance on uncommon earths from China, which dominates the marketplace for the essential supplies.

“Negotiations this fall will probably yield a tenuous settlement,” Dan Alamariu, chief geopolitical strategist at Alpine Macro, wrote in a commentary final week. “The recurring cycle of tension-truce-tension will persist as each powers are more likely to push in opposition to one another, however nonetheless stay too economically intertwined to danger a full rupture.”