Key Takeaways

- Economists say the flurry of insurance policies aimed toward forcing drug firms to decrease costs will not be as efficient as President Donald Trump intends.

- Tariffs are more likely to push up costs, together with for generic medicines and merchandise made within the U.S.

The Trump administration has issued a flurry of orders aimed toward reducing pharmaceutical costs, however specialists are leery that the actions will obtain that aim.

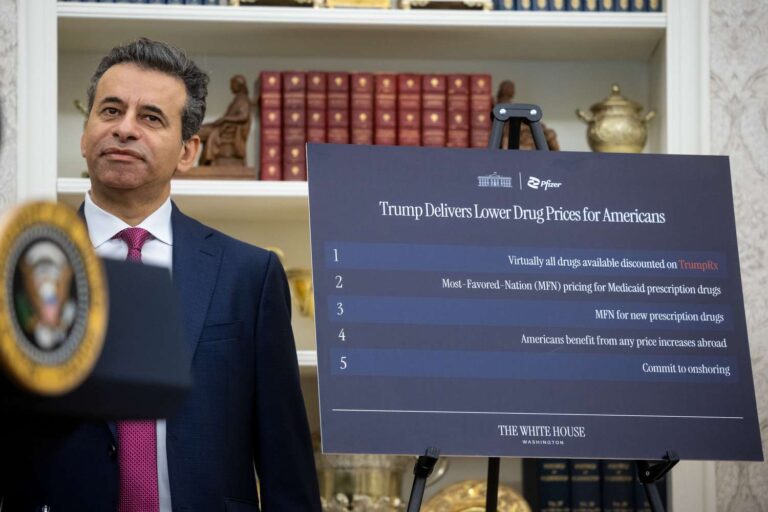

The newest transfer in Trump’s ongoing marketing campaign to cut back drug costs got here late final month when the White Home introduced a deal between the federal government and Pfizer (PFE), the multinational firm that makes COVID-19 vaccines, Viagra, and different extensively used merchandise.

Below the deal, which may function a mannequin for agreements with different main producers, the corporate will promote its merchandise to Medicaid at costs on par with these provided to different developed nations. As well as, the corporate will provide medicines on to customers at a reduction on Trumprx.gov, an internet site scheduled to launch in 2026. In return, the corporate will probably be exempt from the punishing 100% tariffs Trump is threatening to impose on pharmaceutical imports.

The deal seems to handle a longstanding criticism from Trump and U.S. client advocacy teams: the sticker costs for a lot of medicine are considerably increased within the U.S. than in Europe. In some instances, medicine that price hundreds of {dollars} within the U.S. can be found for low price or at no cost to Europeans. For instance, in 2021, a single injection of the arthritis drug Humira price American sufferers $3,000, when a generic model was obtainable in Germany for $10, in line with experiences.

How This Impacts Your Funds

Should you’re at present paying steep costs for brand-name medicine, President Donald Trump’s insurance policies aimed toward lowering pharmaceutical costs are unlikely to decrease them a lot, in line with specialists.

Pricing Controls Will not Change A lot within the U.S.

The pricing controls Pfizer agreed to harken again to an government order Trump issued in Could. The order required that authorities well being businesses, together with Medicare and Medicaid, buy medicine at no increased a price than Most-Favored-Nation pricing—that’s, at a value similar to different developed nations. That is important as a result of the federal government is the most important purchaser of medication within the nation by way of its Medicare and Medicaid medical health insurance applications.

Nonetheless, drug pricing is notoriously sophisticated, making it straightforward for firms to obscure what clients are literally paying. Within the U.S. and Europe alike, most medicine should not bought on to customers, however by way of insurance coverage firms and different middlemen, who usually obtain numerous reductions and rebates that will not be mirrored within the checklist value.

In any case is alleged and finished, Medicaid already pays comparable costs for medicine as its European counterparts, making it unlikely that the MFN coverage will change a lot, stated Geoffrey Joyce, an economist and director of the Schaffer Middle for Well being Coverage and Economics on the College of Southern California.

“Though the MFN coverage accurately captures the urgency of addressing unaffordable U.S. drug costs, it’s unlikely to meaningfully cut back costs as a consequence of authorized, operational, and market obstacles,” Harvard professors Amar H. Kelkar and Edward R. Scheffer Cliff wrote in an editorial for the Journal of the American Medical Affiliation in July.

The Most-Favored-Nation pricing may finally affect the prices of newly launched medicine, pushing down costs within the U.S. and elevating them in Europe, Joyce stated. That might begin to occur within the subsequent three to 5 years, he estimated.

Within the meantime, the business can use a mess of ways to maintain its revenue margins intact.

For instance, in circumstances the place drug costs would truly need to be lowered, pharma firms might as a substitute simply cease providing their medicine in overseas nations. Darius Lakdawalla, chief scientific officer on the USC Schaeffer and Dana Goldman, founding director of the USC Schaeffer Institute for Public Coverage and Authorities Service, wrote in an op-ed.

“Dealing with a selection between deep cuts of their U.S. pricing or the lack of weakly worthwhile abroad markets, we will count on many corporations to drag out from abroad markets at their earliest alternative, leaving U.S. customers with the identical costs, pharmaceutical producers with decrease income, and future generations with much less innovation,” they wrote. “In sum, everybody loses.”

Trump RX Duplicates Personal Firms

The direct-to-consumer portal can also be unlikely to vary a lot, Joyce stated.

Solely about 10% of individuals purchase prescribed drugs straight fairly than by way of insurance coverage. Different firms already provide discounted medicine on to uninsured customers, together with GoodRx and the Mark Cuban Price Plus Firm, so it is unclear what benefit the government-run retailer can have over its non-public counterparts.

Tariffs Might Push Up Costs

If Trump implements pharmaceutical tariffs as promised, the import taxes would doubtless drive up costs, economists stated.

In a social media put up final month, Trump stated the tariffs can be set at 100%, and would solely have an effect on “branded” medicine, seemingly exempting generics, which account for 90% of the medicine bought within the U.S.

Even with out the brand new tariffs, present Trump tariffs on India and China may nonetheless push up drug costs.

Costs will regularly rise as stockpiles run out and contracts are renegotiated, economists at ING stated in a commentary. Costs for generic medicine from India are anticipated to finally rise 25%, they wrote. Costs on domestically manufactured merchandise may additionally rise, as many producers supply their substances from different nations.

Huge, Lovely Invoice Undermines Medicare Value Negotiations

One other issue contributing to the rise in drug costs was tucked away within the large tax and spending laws referred to as the “Huge Lovely Invoice,” which Trump signed into legislation in August.

The invoice features a provision permitting drug firms to exempt extra merchandise from the Medicare value negotiations put into place by former President Joe Biden’s administration. The BBB permits extra medicine to be thought-about “orphan medicine” that deal with beforehand untreated situations.

Joyce stated this provision undermines an avenue of drug value discount that was truly poised to push costs down considerably.