Key Takeaways

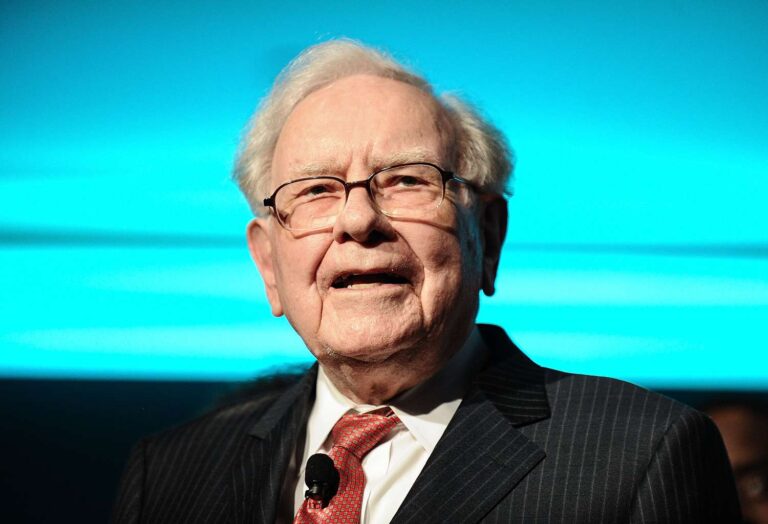

- Warren Buffett, chair and CEO of holding firm Berkshire Hathaway, says inventory splits usually improve transaction prices, invite short-termism, and detach worth from enterprise worth.

- Berkshire created low-denomination Class B shares in 1996, and later break up them 50-for-1 in 2010 as a focused exception to the rule, not as a reversal of precept.

- Buffett’s philosophy goals to draw “business-owner” buyers.

Warren Buffett has lengthy argued towards inventory splits, as he believes they improve buying and selling churn, invite short-term speculators, and detach the share worth from underlying enterprise worth.

Splits have been one step Berkshire Hathaway would by no means absorb Buffett’s view, as these have been proven to degrade the prevailing shareholder constituency and danger reversing “three a long time of laborious work” constructing Berkshire’s base of rational, owner-minded shareholders.

Why Buffett Opposes Inventory Splits

Buffett has targeted on investor conduct and frictional prices in his case towards splits. They:

- improve share turnover, and subsequently the so-called “pickpocket” of transaction prices;

- entice speculative patrons who give attention to the value quote, not worth; and subsequently,

- result in costs that deviate from intrinsic worth.

He thus concluded there have been “no offsetting benefits” to splitting Berkshire’s conventional, Class A shares.

Buffet’s broader purpose is a market worth that’s rationally associated to intrinsic worth. That requires self-selecting, long-term house owners who assume like enterprise companions relatively than merchants. A decrease share rely to make the sticker worth decrease, he argues, entices the improper crowd: “Individuals who purchase for non-value causes are prone to promote for non-value causes.”

Two Exceptions: Class B Shares and a 50-for-1 Cut up

Buffett did, nonetheless, make two exceptions in Berkshire’s historical past that will muddy the waters in relation to splits. The primary was Berkshire’s creation of Class B shares (BRK.B) in 1996 to fight the proliferation of high-fee Berkshire “clone” trusts and to supply a lower-denomination car for actual long-term buyers to spend money on Berkshire.

He emphasised this was to protect the shareholder tradition that helped his funding choices. B-class have been set at roughly 1/thirtieth of an A share (with a discount in voting rights) to be helpful, however nonetheless have a sufficiently big entry ticket to maintain out the purely speculatively minded. At the moment, the B shares commerce for 1/1,500 the market worth of A shares.

Second, in 2010 Berkshire executed a 50-for-1 break up of Class B shares to consummate the Burlington Northern Santa Fe (BNSF) acquisition. Berkshire’s regulatory filings explicitly framed the break up as a strategy to facilitate the deal, relatively than as a brand new stance on inventory splits.

What It Means for Traders

For buyers, there are two takeaways.

- Don’t mistake a decrease sticker worth for worth. A break up doesn’t change the basics of the enterprise, however it might change conduct across the inventory. Buffett desires that conduct aligned with long-term fundamentals, not short-term buying and selling impulses.

- Allow entry with out watering down philosophy. The twin-class construction permitted smaller buyers to buy B shares with out diluting A shares. This has enabled Berkshire to make strategic investments whereas sustaining the tradition of its base of core buyers.

Quick Reality

In This fall 2025, Berkshire Hathaway Class A shares (BRK.A) traded for round $750,000 per share.

The Backside Line

Buffett was blunt about this subject. A break up, he wrote, would elevate buying and selling prices, downgrade the shareholder inhabitants, and encourage costs much less consistently-related to intrinsic enterprise worth. His strategy through the years has not modified, at the same time as Berkshire added B shares and break up these for particular acquisition functions, all of the whereas sustaining that A shares would by no means be break up.