If you wish to add vital upside potential to your portfolio, take a look at electrical automotive shares. In 2021, electrical autos (EVs) represented simply 3.4% of all car gross sales within the U.S. By 2030, nonetheless, practically 30% of all car gross sales are anticipated to be electrical.

As Tesla inventory has confirmed, large beneficial properties are doable by investing early. Whereas loads of dangers stay, Lucid Group (LCID 0.66%) might very nicely be the subsequent Tesla, probably producing enormous wealth to your portfolio within the course of. Proper now, there are two causes specifically to consider Lucid shares are a compelling “purchase it for all times” funding.

1. Lucid is able to faucet the mass market

One of many largest drivers of development in an EV maker’s journey is the launch of so-called “mass market” autos. These are automobiles which can be reasonably priced to the lots, with worth tags sometimes beneath $50,000. But once more, Tesla supplies clear proof of how precious the launch of mass market autos could be. Immediately, its two most reasonably priced fashions — the Mannequin 3 and Mannequin Y — account for greater than 90% of its car gross sales. With out these two fashions, Tesla would arguably be only a fraction of its present measurement.

Proper now, Lucid is much from attaining Tesla’s measurement and scale. Final yr, the corporate had only one mannequin in the marketplace: The Lucid Air, a sedan that may simply value greater than $100,000 relying on choices. In early 2025, Lucid doubled its lineup with the launch of its Gravity SUV platform. Analysts consider that this can assist gross sales develop by 72% this yr, with one other 97% development anticipated in 2026. However the Gravity SUV can even value upwards of $100,000 relying on choices, limiting its enchantment to a large viewers.

By the tip of subsequent yr, nonetheless, Lucid expects to start out manufacturing of two mass market autos: a sedan and a crossover, each priced beneath the vital $50,000 threshold. These autos will primarily compete face to face with Tesla’s Mannequin 3 and Mannequin Y. “Lucid doesn’t exist to be a distinct segment luxurious producer,” the corporate’s former CEO, Peter Rawlinson, confused in February.

Critically, Rawlinson departed Lucid abruptly a couple of weeks after these feedback have been made, placing his optimistic timeline in jeopardy. If the launch timeline is maintained, nonetheless, we might see Lucid’s development rise exponentially in 2027, following what are anticipated to be banner years in each 2025 and 2026.

The approaching launch of two new mass market autos ought to get buyers excited. However there’s one other development alternative that would arguably be much more profitable in the long run.

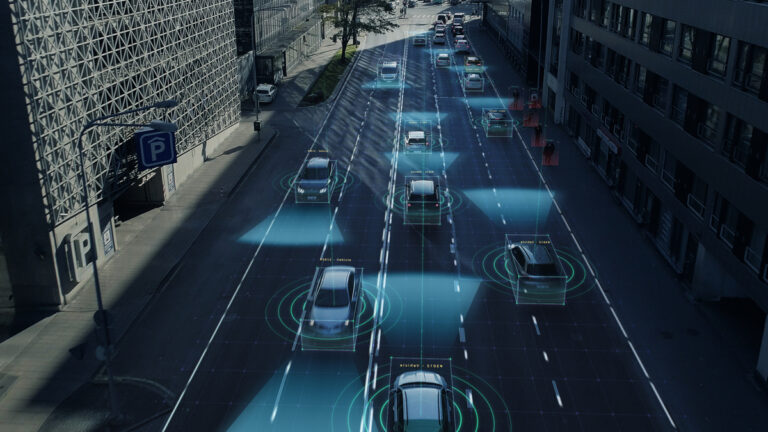

Picture supply: Getty Photos.

2. Lucid’s largest development alternative will not be making EVs

Rawlinson wasn’t shy about his expectations for the corporate. “We would like Lucid to be enormous,” he mentioned earlier this yr earlier than his departure. He needed the corporate to provide greater than 1,000,000 automobiles yearly by the early 2030s. Past that, he thought Lucid’s future could be to easily promote its know-how to different automakers — an arguably extra worthwhile enterprise with better scaling potential.

Lucid’s transition towards this future has already begun. In 2023, it introduced a partnership with Aston Martin. The deal made it in order that Aston Martin might acquire entry to Lucid’s proprietary powertrain know-how, which might be carried out in upcoming Aston Martin EVs.

In December 2024, Lucid teased that it was speaking with “a pair” of different producers about comparable offers. “It could be beautiful if we might provide know-how to a standard automotive firm to assist them on their option to sustainability,” Rawlinson commented. “Maybe we will leverage economies of scale with their components bin and different features of the enterprise.”

We’ve not acquired any up to date commentary from new CEO Marc Winterhoff. However long run, Lucid’s automotive manufacturing enterprise ought to merely be a option to showcase its know-how. If that is true, we might see Lucid transitioning to this enterprise mannequin fully, since tech licensing sometimes generates larger revenue margins and better scaling alternatives. As EV penetration takes off, Lucid might primarily promote its know-how to the winners, quite than needing to compete immediately itself.

Whereas there stays loads of execution danger, this makes Lucid a promising funding that would generate immense wealth over a multi-decade holding interval.