What occurred

In line with a submitting with the Securities and Trade Fee dated October 17, 2025, funding administration firm Capricorn Fund Managers Ltd established a brand new place in Waystar (WAY 0.46%), buying 505,122 shares. The estimated transaction worth, based mostly on the common closing worth throughout the third quarter of 2025, was roughly $19.15 million. This addition brings the fund’s complete reported positions to 59 at quarter-end.

What else to know

The brand new place in Waystar accounts for six.4% of Capricorn Fund Managers’ 13F reportable belongings beneath administration. The inventory is now the fund’s largest holding by reported market worth.

The fund’s high holdings after the submitting are:

- WAY: $19.15 million (6.4% of AUM)

- TARS: $14.26 million (4.8% of AUM)

- MSFT: $14.15 million (4.8% of AUM)

- VERA: $13.10 million (4.4% of AUM)

- REAL: $12.64 million (4.2% of AUM)

As of October 16, 2025, shares of Waystar have been priced at $36.81, up 34% over the one-year interval, outperforming the S&P 500 by 20 proportion factors throughout the identical timeframe.

Firm overview

MetricValuePrice (as of market shut October 16, 2025)$36.81Market capitalization$7.06 billionRevenue (TTM)$1.01 billionNet earnings (TTM)$85.94 million

Firm snapshot

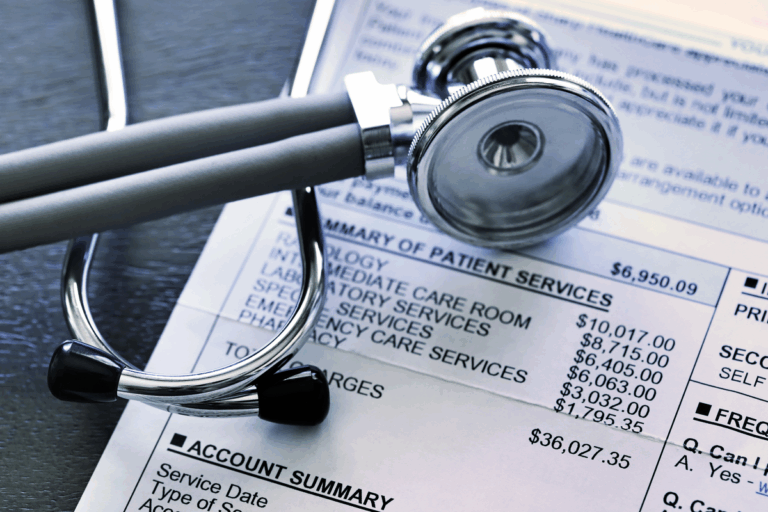

Waystar gives a cloud-based software program platform for healthcare funds, together with options for monetary clearance, affected person monetary care, claims and fee administration, denial prevention and restoration, income seize, and analytics.

IMAGE SOURCE: GETTY IMAGES.

The corporate serves healthcare organizations as its major clients, concentrating on suppliers in search of to optimize income cycle administration and fee processes.

Waystar was based in 2017 and is headquartered in Lehi, Utah, working within the expertise sector with roughly 1,500 staff. The corporate operates at scale within the healthcare expertise trade, specializing in streamlining fee processes for healthcare suppliers via its cloud-based platform.

Silly take

Capricorn Fund Managers’ new place in Waystar inventory deserves consideration for a couple of causes. The funding administration firm not solely deemed Waystar a invaluable addition to its portfolio, however the buy was so massive, the inventory catapulted to the highest of its holdings.

Investing in Waystar is sensible. The enterprise boasts some compelling qualities. It has grown income each quarter for the previous two years, and the development continues in 2025.

In Q2, Waystar’s gross sales rose 15% yr over yr to $270.7 million. The corporate expects to hit $1 billion in income this yr, up from $944 million in 2024.

Waystar additionally had a strong stability sheet exiting Q2. Whole belongings have been $4.7 billion in comparison with complete liabilities of $1.5 billion. It does have over $1 billion in debt, however the firm is slowly paying this down.

The constant gross sales development Waystar is experiencing, and its ahead price-to-earnings ratio of about 25, which is affordable for a fast-growing tech firm, explains Capricorn Fund Managers’ massive purchase of Waystar inventory. These components make the inventory a worthwhile funding for the lengthy haul.

Glossary

13F reportable belongings beneath administration: The whole worth of securities a fund should disclose quarterly to the Securities and Trade Fee (SEC) on Type 13F.

Stake: The possession curiosity or funding a fund or particular person holds in an organization.

Initiated place: When an investor or fund purchases shares of an organization for the primary time.

Property beneath administration (AUM): The whole market worth of investments managed by a fund or funding agency.

Quarter-end: The final day of a fiscal quarter, used for monetary reporting and portfolio snapshots.

Outperforming: Reaching a better return or development fee in comparison with a benchmark or index.

Cloud-based platform: Software program and companies delivered over the web moderately than put in regionally on computer systems.

Income cycle administration: The method healthcare suppliers use to trace affected person care income from appointment to ultimate fee.

Denial prevention and restoration: Methods to scale back and resolve rejected insurance coverage claims in healthcare billing.

Market worth: The present value of an asset or holding based mostly on the newest market worth.

Healthcare funds: Monetary transactions associated to medical companies, together with billing, claims, and reimbursements.

TTM: The 12-month interval ending with the newest quarterly report.

Robert Izquierdo has positions in Microsoft. The Motley Idiot has positions in and recommends Microsoft. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.