Need extra housing market tales from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub publication.

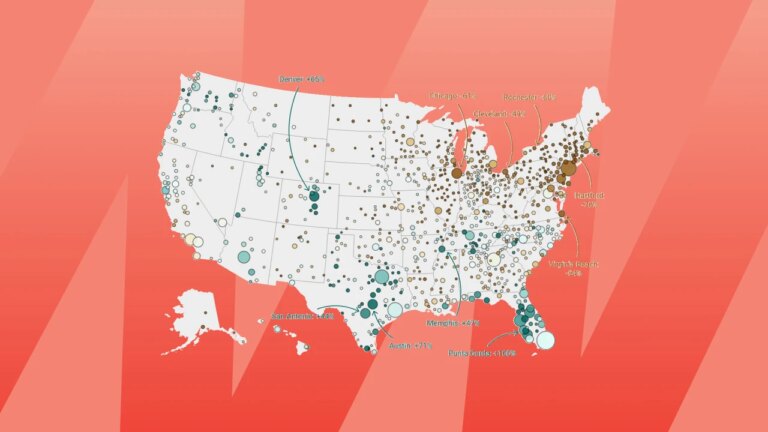

Nationwide lively housing stock on the market on the finish of June this 12 months was up 29% in contrast with June 2024. That’s simply 12% beneath pre-pandemic ranges in June 2019. Nevertheless, whereas the nationwide housing market has softened and stock has surpassed 2019 pre-pandemic ranges in some pockets of the Solar Belt, many housing markets stay far tighter than the nationwide common.

Typically talking, housing markets the place stock (i.e., lively listings) has returned to pre-pandemic ranges have skilled softer/weaker dwelling value development (or outright declines) over the previous 36 months. Conversely, housing markets the place stock stays far beneath pre-pandemic ranges have, typically talking, skilled extra resilient dwelling value development over the previous 36 months.

Pulling from ResiClub’s month-to-month stock tracker, we recognized the tightest main housing markets heading into the spring 2025 season, the place lively stock continues to be the furthest beneath pre-pandemic 2019 ranges. These markets are the place dwelling sellers have maintained extra energy in contrast with most sellers nationwide.

A lot of these tight markets are within the Northeast, particularly, in states like New Jersey and Connecticut.

In contrast to the Solar Belt, many markets within the Northeast and Midwest had been much less reliant on pandemic-era migration and have fewer new dwelling development initiatives in progress. With decrease publicity to the detrimental demand shock brought on by the slowdown in pandemic-era migration—and fewer homebuilders in these areas providing affordability changes as soon as charges spiked—lively stock in lots of Northeast and Midwest housing markets has remained comparatively tight, sustaining a vendor’s benefit heading into spring 2025.

!operate(){“use strict”;window.addEventListener(“message”,operate(a){if(void 0!==a.information[“datawrapper-height”]){var e=doc.querySelectorAll(“iframe”);for(var t in a.information[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.supply){var d=a.information[“datawrapper-height”][t]+”px”;r.fashion.peak=d}}})}();

That every one stated, this cohort is slowly shedding members. Again in Might, 32 of the nation’s 200 largest metro-area housing markets nonetheless had at the very least 50% less-active stock than in June 2019. In April, there have been 37 markets. In March, there have been 42 markets.