Key Takeaways

- The Federal Reserve reduce charges by 25 foundation factors to 4% to 4.25% on Wednesday, a choice that had traders positioning their portfolios forward of time.

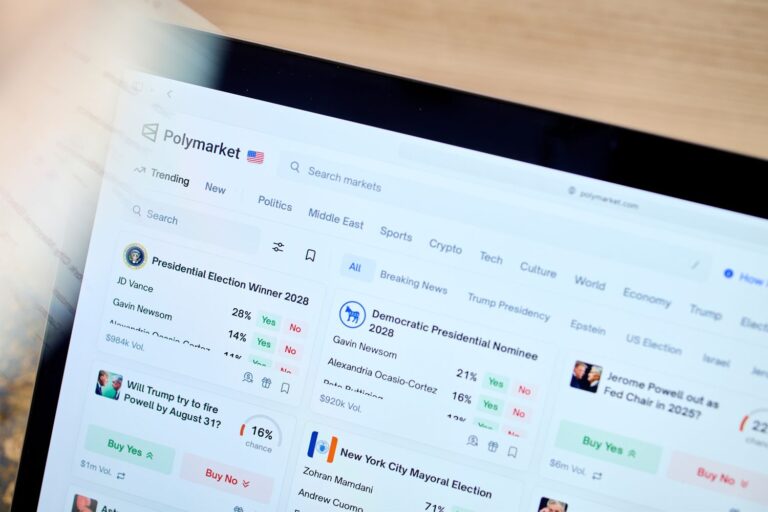

- Main traders weren’t the one ones speculating on the transfer: Prediction markets noticed over $300 million wagered on this week’s Fed determination throughout platforms managed by Kalshi, Polymarket, Robinhood Markets (HOOD), and Interactive Brokers Group (IBKR).

- The expansion in prediction markets has helped rework financial coverage into America’s latest betting spectacle.

Individuals wagered greater than $300 million on the Fed’s quarter-point rate of interest transfer this week—not by way of complicated derivatives or bond trades, however on platforms that work like DraftKings for financial coverage.

The Federal Reserve’s anticipated 25 foundation level reduce was anticlimactic—specialists had anticipated it for weeks—so the actual drama unfolded on prediction market platforms the place you’ll be able to wager sure/no on cultural, political, and financial questions.

Is that this subtle hedging, or has America’s playing downside discovered a brand new recreation? Wall Road quants nonetheless have intricate methods to invest on the Fed’s strikes, however with platforms already lining as much as take bets on October’s assembly, it is clear that the dryness of financial coverage jargon and Jerome Powell’s pressers have not stopped them from becoming a member of the Tremendous Bowl as spectacles Individuals are able to wager massive on.

How Fed Funds Charge Adjustments Turned Into Massive-Time Wagers

Whereas the a whole bunch of hundreds of thousands wagered on this week’s Fed determination pales subsequent to Polymarket’s $3.2 billion presidential election bonanza, it nonetheless represents severe cash—and severe progress.

Kalshi’s $91 million almost doubled their earlier two Fed conferences mixed.

Polymarket’s quantity topped $208 million.

Interactive Brokers, which solely just lately launched Fed-focused contracts by way of its ForecastTrader platform, stated they’ve turn into “amongst our hottest devices,” in line with director of public relations Kat Ewert.

Robinhood, too, noticed a spike in buying and selling associated to the Fed’s strikes, telling Investopedia that just about 40 million contracts traded inside its Fed prediction market this month.

Robinhood’s representatives stated the retail platform has seen over 2 billion contracts traded thus far this yr throughout all prediction markets. Whereas the platform noticed about 500 million contracts traded within the week main as much as the presidential election, Fed selections generated their very own surge—tens of hundreds of thousands of contracts this month alone, the corporate stated.

“Whether or not it is sports activities, economics, financials, politics, or another kind of prediction market we provide, there may be at all times a spike in curiosity and exercise because the occasion approaches,” JB Mackenzie, vice chairman and basic supervisor of futures and worldwide at Robinhood, advised Investopedia.

Throughout all platforms, merchants overwhelmingly wager on a 25-basis-point reduce, with odds climbing to 80% to 90% within the closing days, falling consistent with analysts’ predictions and, certainly, the Fed’s fee reduce this week.

Buying and selling the Fed: Then vs. Now

The normal method to speculate on the Fed’s strikes was to purchase or promote Treasury bonds: if you happen to thought the Fed would reduce charges, you’d purchase shorter-term bonds, anticipating yields to fall and bond costs to rise. For those who anticipated a hike, you’d promote or quick bonds, betting yields would climb.

One other avenue was the Fed funds futures market, the place merchants primarily positioned bets on the place the in a single day lending fee would land at a particular future date. Some traders used rate of interest swaps or short-term debt devices like Treasury payments to play the identical recreation, whereas extra aggressive merchants shorted high-yield debt or piled into floating-rate notes.

How the Prediction Markets Work

All of those oblique strategies are complicated and infrequently require vital capital. Against this, right now’s prediction markets strip the wager right down to its easiest kind: a dollar-for-dollar contract that pays off if you happen to’re proper and zeroes out if you happen to’re improper.

This method has attraction. In an electronic mail to Investopedia, Jack Such, head of media for Kalshi, stated that Kalshi has seen “exponential enhance in new customers and buying and selling quantity in 2025.” And, similar to in Vegas, the motion is not stopping: betting traces for October’s Fed assembly are already reside, with merchants putting 80% odds on one other 25 foundation level reduce on Polymarket.

On platforms like Kalshi, Fed selections are priced as sure/no contracts, with every cent representing a 1% likelihood, ranging between $0.01 and $0.99. Purchase “Sure” on a 25 foundation level reduce at 79 cents, and you will obtain $1 if you happen to’re proper—a 27% return. For those who’re improper, your contract goes to zero.

“Utilizing Kalshi is a superior method to commerce on the Fed’s determination due to the shortage of abstraction,” Such stated. Not like the bond market, the place “you may be proper and nonetheless find yourself dropping cash,” prediction markets strip the wager right down to its essence: a dollar-for-dollar contract that pays off if you happen to’re proper and goes to zero if you happen to’re improper.

The attraction goes past simplicity.

“Prediction markets leverage the ability and rigor of economic market construction,” Mackenzie stated. “Clients can entry occasion contracts in actual time and handle threat by adjusting—or exiting—their positions proper up till a contract expires.”

Tip

Every cent in a contract worth is usually learn as 1% odds, however that’s solely a information. Buying and selling charges, liquidity, and threat preferences can push your precise returns away from the “true” possibilities.

However the authorized panorama stays murky.

Kalshi received a vital victory final fall when a federal choose dominated that the Commodity Futures Buying and selling Fee (CFTC) exceeded its authority in blocking Kalshi’s election contract. In Could 2025, the CFTC dropped its attraction, clearing the trail for these listings for political prediction markets. That ruling emboldened platforms to increase past politics into Fed selections, earnings reviews, and financial knowledge—all working in a regulatory grey zone between monetary derivatives and playing.

Polymarket operates offshore, whereas Kalshi has CFTC approval as a chosen contract market. Interactive Brokers affords comparable contracts by way of ForecastEx. Every platform insists they’re providing legit monetary devices for hedging and worth discovery, not playing merchandise—a distinction that many state gaming regulators and representatives of America’s gaming trade dispute.

“We’ve got severe issues relating to their frivolously regulated choices and potential results to shopper protections, gaming integrity, and duty,” Joe Maloney, a senior vice chairman of strategic communications on the American Gaming Affiliation, advised Investopedia. The group says its surveys present {that a} overwhelming majority (85%) of Individuals view the sports activities model of those contracts as playing, not monetary devices.

The Backside Line

The greater than $300 million wagered on this week’s Fed determination exhibits how on a regular basis Individuals checking on financial coverage is about extra now than the potential course of mortgage and bond charges. Whether or not occasions contracts sign the democratization of finance or the gamification of coverage, the impact is identical: Fed conferences are actually marquee occasions with odds, payouts, and a whole bunch of hundreds of thousands at stake.