The world envies Swiss chocolate, military knives, and now . . . rates of interest?

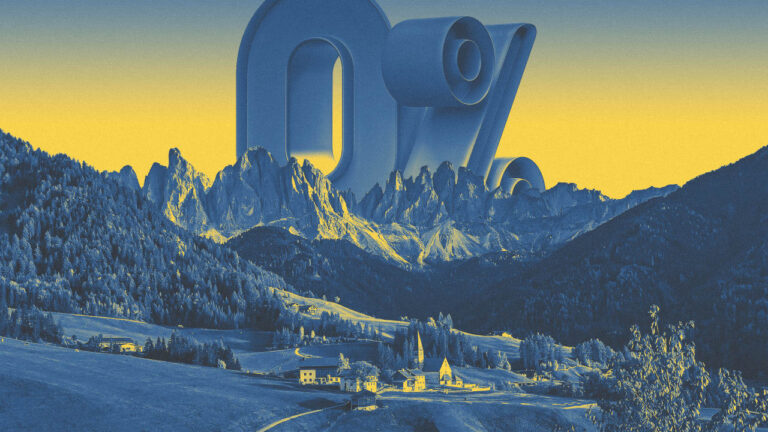

Swiss Nationwide Financial institution, Switzerland’s central financial institution, moved rates of interest to zero this week, a discount of 25 foundation factors, and a notable detraction from different central banks around the globe, such because the Federal Reserve within the U.S. and the Financial institution of England within the U.Ok.

In an announcement, the Swiss Nationwide Financial institution stated that the transfer was made in relation to declining inflation worries—and that it’s anticipating the economies to buckle beneath the volatility created, partially, as a result of Trump administration’s commerce insurance policies.

“With right this moment’s easing of financial coverage, the SNB is countering the decrease inflationary strain. The SNB will proceed to watch the scenario intently and regulate its financial coverage if essential, to make sure that inflation stays inside the vary in line with worth stability over the medium time period,” the assertion learn.

“The worldwide financial outlook for the approaching quarters has deteriorated as a result of enhance in commerce tensions. In its baseline state of affairs, the SNB anticipates that development within the international financial system will weaken over the approaching quarters. Inflation within the U.S. is more likely to rise over the approaching quarters. In Europe, against this, an additional lower in inflationary strain is to be anticipated.”

In the meantime, within the U.S., the Federal Reserve’s newest assembly wrapped up this week with no change in rates of interest, regardless of strain from the White Home and others to decrease them. Fed Chair Jerome Powell and different Fed governors have been reluctant to take action, as inflation knowledge nonetheless has not gotten shut sufficient to its 2% goal, and employment knowledge has remained constructive.

Throughout the Atlantic, nonetheless, one other European nation, Norway, additionally lower charges this week. And a few specialists assume that the Swiss may go even additional, instituting destructive rates of interest in some unspecified time in the future this yr.

“There are dangers that the SNB will go additional sooner or later if inflationary pressures don’t begin to enhance, and the bottom the coverage charge may go is -0.75%, the speed it reached within the 2010s,” Swiss Nationwide Financial institution’s Chairman Martin Schlegel advised CNBC on Thursday. “However what I can say is that going destructive, we’d not take this determination flippantly.”