Sixty-two looks like the proper age to retire. In any case, you can begin accumulating Social Safety. Plus, you are still younger sufficient to get pleasure from it.

It is no surprise 62 is the typical age of retirement in America. However retiring at that age or earlier could possibly be one of many largest errors an individual could make.

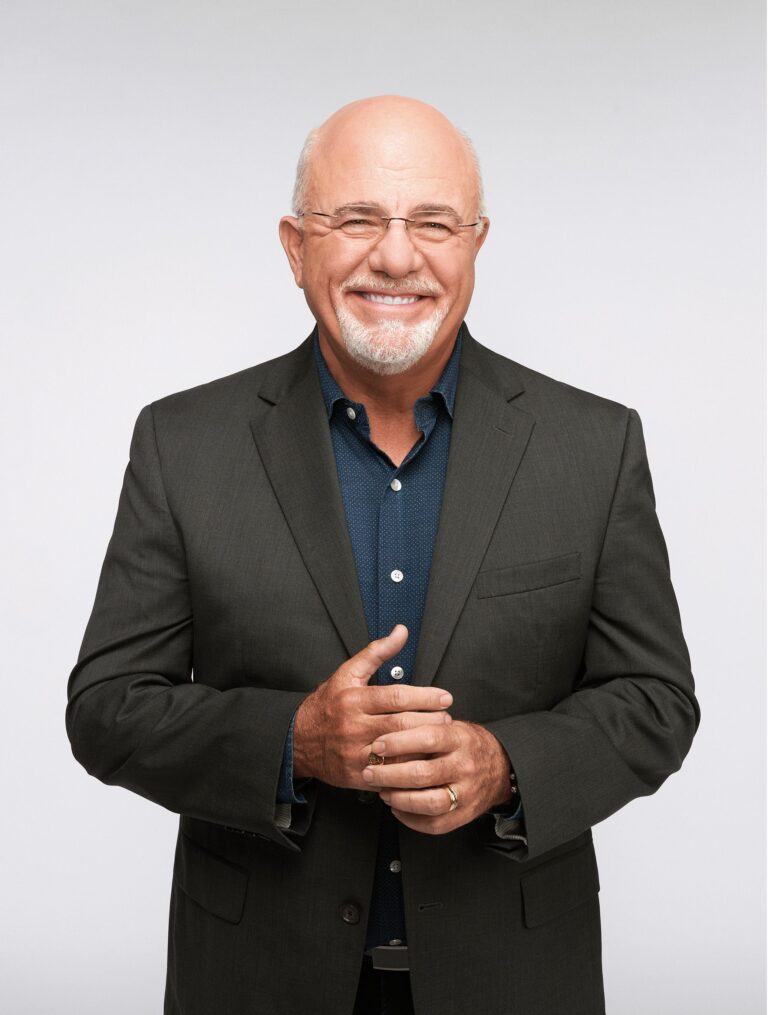

Not less than based on retirement professional, creator and podcaster Dave Ramsey.

“Individuals underestimate how lengthy they’ll stay and the way a lot cash they’ll want,” Ramsey tells Kiplinger.com. “They retire broke or approach too early. It is like leaping out of a aircraft with out checking your parachute.”

This is applicable to the tens of millions of people that select to retire early, not those who’re compelled out of their jobs due to an sickness, incapacity, workforce discount, or a sick member of the family they need to look after.

Been There, Completed That

Ramsey has seen it earlier than. For over twenty years, the creator, founder and CEO of Ramsey Options and host of “The Ramsey Present,” has helped tens of millions of individuals get out of debt, take cost of their monetary lives and obtain their retirement targets.

He speaks from expertise. After working up hundreds of {dollars} in debt and being compelled to declare chapter at age 26, Ramsey not solely climbed out of the monetary gap he created however went on to construct a profession instructing others the way to obtain monetary freedom.

The knock on retiring early

Retiring early is the dream of tens of millions of Individuals, no matter whether or not meaning exiting the workforce of their 50s or early 60s. Whereas there are benefits to early retirement, there are additionally some clear disadvantages that make Ramsey staunchly towards it.

For starters, should you retire earlier than Medicare kicks in at 65, you’ll have to fund your personal well being care, which may get costly. Plus, should you don’t plan to work at the least part-time, you’ll have to determine the way to develop your financial savings and generate money circulate. With so a few years and not using a regular revenue, there’s a likelihood you may run out of cash. If you happen to retire at 62 and accumulate Social Safety, be keen to take as much as a 30% discount in advantages on your lifetime.

All of this can be superb should you’ve saved sufficient for retirement and also you’re flush with money. However should you depend on Social Safety to complement your month-to-month revenue, a discount in your advantages since you retired early may affect your high quality of life. Moreover, retiring early means much less cash saved, plus extra years you need to draw out of your financial savings.

“Don’t retire till you’re actually prepared,” says Ramsey. “Which means zero debt, a totally funded nest egg, and a transparent month-to-month finances. Work longer if it is advisable to, and finances like your future will depend on it — as a result of it does.”

Relating to debt, Ramsey says do away with it earlier than retirement. (Picture credit score: Ramsey Options)

Retire debt-free

Retiring with debt is one other one of many largest retirement errors Ramsey encounters. Individuals suppose they’ll deal with the month-to-month mortgage fee and/or automotive fee, however one sudden sickness or accident, and unexpectedly, they’re in over their heads.

That’s why Ramsey says individuals ought to be completely debt-free in retirement, together with paying off their mortgage, no matter a low rate of interest. Once you owe cash, you may’t obtain monetary freedom and safety in retirement.

“They dangle onto debt. Particularly mortgages and automotive funds. Then they assume they’ll simply ‘handle it’ in retirement,” says Ramsey. “The repair is easy. Assault that debt with depth now, earlier than you step into your golden years.”

It’s by no means too late to repair your retirement errors

Retirement isn’t the top of the highway. If you happen to make errors, reminiscent of retiring too early or with too little cash, you will have choices to repair them. You’ll be able to return to work, downsize or cut back your finances.

If you happen to haven’t retired but, you may put within the work now to organize for it or delay retiring to get your self in a greater place later.

“It’s by no means too late to begin doing the precise factor,” says Ramsey. “It’s possible you’ll not have 40 years left, however you’ve received as we speak. And that’s sufficient to begin turning the ship round.”