Some customers have develop into tremendous cautious, however that’s not stopping Crocs Inc. CEO from taking some daring steps to make sure sustainable development on a going-forward foundation.

“As we’ve constantly stated, we’re not attempting to handle our enterprise quarter-to-quarter. We had a strong first half of the yr with our manufacturers fueling sturdy gross revenue and money circulate. The present setting within the second half is regarding, and we see that clearly mirrored in retail order books,” Crocs CEO Andrews Rees stated. “We strongly consider it is a time to make daring selections for the long run to maintain and advance our sturdy money circulate mannequin. In consequence, we’ve chosen to amplify sure measures within the second half of the yr to guard model well being and profitability.”

Rees instructed traders in a convention name on Thursday after the corporate posted second quarter outcomes {that a} portion of the buyer base is now not going to shops, and that has impacted the shoe agency’s wholesale enterprise. Not solely are order books down for the beginning of the second half, however the lower-end client can also be making fewer journeys to the agency’s outlet shops, he stated. The decline in orders has the corporate, partially, anticipating a 9 % to 11 % lower in third quarter income. Rees emphasised that the projection “embeds conservative assumptions round returns of cancelations.” He additionally stated the corporate is shedding some shelf house to athletic manufacturers, however can also be engaged on selecting up shelf house in the summertime with sandals.

Regardless of that early pattern, he stated there’s additionally been sturdy trajectory within the sandal enterprise, which is predicted to develop subsequent yr, helped by new product innovation on clogs slated for the fourth quarter. And the agency is rising its personalization enterprise, “each in Jibbitz and increasing that past Jibbitz right into a broader personalization provide,” Rees stated.

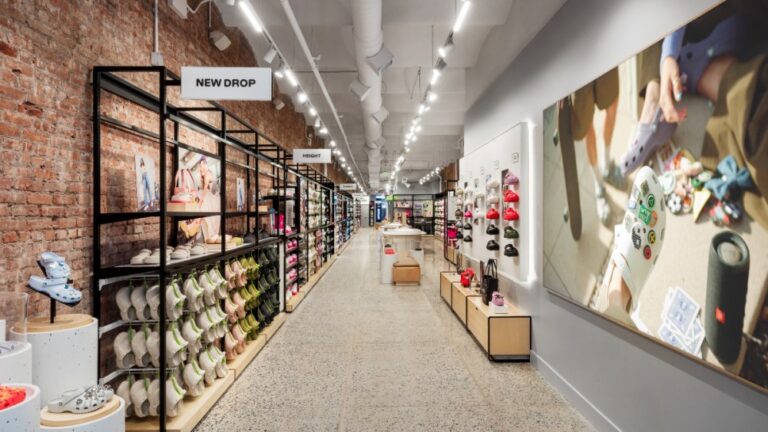

Crocs final week opened its new Icon retailer at 543 Broadway within the SoHo neighborhood in Manhattan. The idea, which permits for internet hosting purchasing occasions, additionally incorporates two areas for personalization choices.

For the Crocs model, he stated the corporate, along with adjusting its ahead receipts, has pulled again on promotional exercise throughout the direct channels since Could.

“Whereas this has and can proceed to impression our prime line, we see this as a chance to drive margin {dollars} over time, help continued money circulate technology and tightened model management,” Rees stated.

For the Hey Dude model, the corporate accelerated its actions within the channel to help a clear and refreshed market. “This has resulted in us selecting to take again further aged stock and guarantee extra of our companions are reset with our present product strains,” he stated.

These actions will create additional headwinds to gross sales quantity over the subsequent a number of quarters. Rees stated the corporate has taken further measures that has resulted in $50 million of price financial savings because it continues to establish additional cost-saving alternatives. The corporate can also be planning its enterprise conservatively by “proactively pulling again on receipts throughout each manufacturers for the second half, primarily within the U.S. with out shedding sight of the larger image,” he stated.

Rees stated the corporate has additionally accelerated its worldwide enterprise, which has grown from 38 % of Crocs model gross sales in 2022 to 52 % within the second quarter ended June 30. Different initiatives embody diversification in its clog choices, the event of a robust sandals enterprise and the expansion of its personalization class, one that features its Jibbitz charms.

“Collectively, this diversification ought to gasoline sturdy long-term development for years to come back,” Rees stated.

Rees additionally stated the corporate stays “laser-focused on its digital-led social-first advertising playbook as it is a key ingredient in sustaining model warmth.” Along with bringing again franchise favorites, he stated the corporate continues to lean into social commerce as customers are beginning and ending their purchasing journeys on social media platforms.

“Throughout the quarter, Crocs remained the No. 1 footwear model on TikTok store within the U.S.,” Rees stated, including {that a} TikTok U.Okay. platform was not too long ago launched, “the place outcomes have been sturdy out of the gate.”

Wanting forward, Rees stated the plan is to “proceed to increase social commerce and stay streaming platforms globally, and we anticipate this to drive new development alternatives.”

As for tariffs and its impression, Rees stated the corporate can “over the medium time period mitigate” the impression of tariffs. That may come from price financial savings within the provide chain, negotiations with factories and a few value changes, he stated.

For the second quarter the web loss was $492.3 million, or $8.82 a diluted share, towards web earnings of $228.9 million, or $3.77, in the identical year-ago quarter. Revenues rose 3.4 % to $1.15 billion from $1.11 billion. Inventories have been larger at $405 million, or up 7.4 %, versus $377 million final yr. That improve displays partially larger tariff prices.

Nonetheless a drag on operations is the Hey Dude model, which continues to point out indicators of battle. Rees stated over the previous 12 months the corporate has been targeted on talking to a brand new feminine client, whereas not shedding sight of its core clients. The corporate can also be engaged on stabilizing the North American market because it lays the groundwork for worldwide development. “We consider the Hey dude potential and its group are a lot higher than the scale of the enterprise as we speak, and we’re assured that the essential steps we’re taking will gasoline the potential sooner or later,” Rees stated.

Needham analyst Tom Nikic stated on Thursday that whereas there was second quarter enchancment for the Hey Dude model, he isn’t so certain the model might be worthwhile in both the second half or in 2026. That’s due partially to tariffs and an accelerated cleanup of the wholesale channel, whereas a pullback in efficiency advertising might damage direct-to-consumer revenues, the analyst stated.

Crocs stated in December 2021 that it was buying the privately owned Hey Dude footwear model, which had a deal worth of $2.5 billion. The transaction was accomplished in February 2022.