Finnish quantum computing startup IQM is now a unicorn: The corporate simply raised greater than $300 million in a Collection B funding spherical that was led by Ten Eleven Ventures, a U.S. funding agency targeted on cybersecurity.

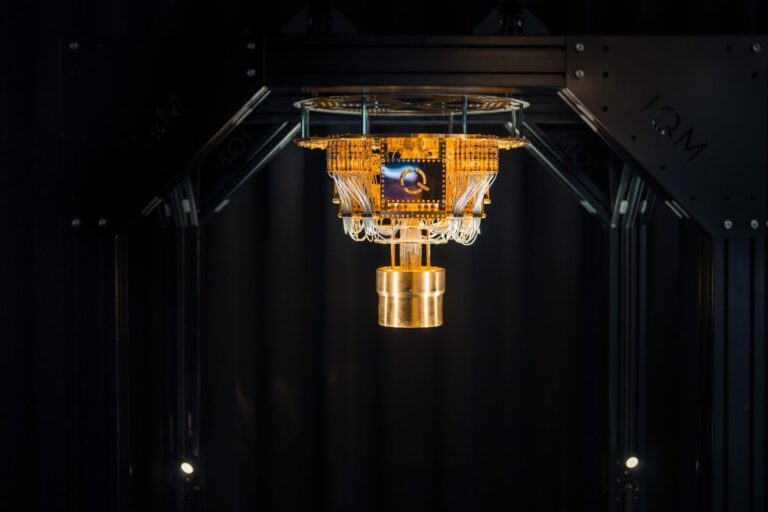

A college spinout, IQM builds quantum computer systems meant for on-premises installations in addition to a cloud platform that faucets this {hardware}. The corporate has already bought its quantum computer systems to enterprises in APAC and the U.S., however its strongest market stays Europe.

That’s what this spherical is meant to alter: the startup is planning to make use of the contemporary money for each a business push in addition to R&D to align with the market’s evolving understanding of what’s wanted to show advances in quantum science into sensible affect.

To win U.S. purchasers within the face of competitors from huge tech firms like IBM, Google, and Microsoft, IQM is aware of it should speed up its roadmap for each {hardware} and software program. In keeping with its co-CEO and co-founder Jan Goetz, this implies investing extra within the firm’s chip fabrication amenities, in addition to in software program growth and error correction analysis.

Error correction, the flexibility to detect and repair errors inherent in quantum programs, is a scorching matter proper now, provided that the very notion of what makes a quantum laptop aggressive is being redefined — having the ability to compute a lot of qubits is much less of a holy grail at this time than it was once. “It’s all the time a trade-off between variety of qubits and high quality and reliability,” Goetz stated.

Navigating this trade-off can be essential for creating real-world makes use of for quantum computing which have lengthy been envisioned however weren’t prioritized. However now that quantum advances over conventional supercomputers now not appear the the stuff of sci-fi, firms like IQM are attempting to verify their computer systems may have sensible purposes ahead of later.

Reliability apart, IQM’s roadmap aligns with the sector’s rising give attention to the software program layer that can be required to place quantum computing within the arms of its first finish customers: consultants with PhDs in fields that aren’t quantum computing.

Techcrunch occasion

San Francisco

|

October 27-29, 2025

A right away software-related goal for IQM is to construct a developer platform that, Goetz says, is akin to “an SDK for quantum computing,” with the objective to “usher in as many builders as doable to start out engaged on our machines.” As a substitute for IBM’s method, this platform will depend on Qrisp, an open-source mission by Berlin-based analysis institute FOKUS.

Second to its headquarters in Finland, Germany is the place most of IQM’s 300 staffers are situated, with a big R&D unit understanding of Munich, Goetz stated. “However with this spherical, we wish to develop the crew and create extra business traction, particularly within the U.S.”

Sooner or later, the corporate is contemplating turning into “a bit extra operational within the U.S.,” stated Goetz, including that tariffs might play a job on this determination. “One factor that we’re contemplating is that if we promote extra programs within the U.S., we might do native meeting.”

However IQM will stay targeted on gross sales within the U.S. in the meanwhile. The corporate just lately bought an on-premise quantum laptop to the Oak Ridge Nationwide Laboratory, a science lab run by the U.S. Division of Power.

In keeping with Ten Eleven Ventures’ co-founder and managing basic companion, Alex Doll, there’s a robust overlap between the funding agency’s thesis and IQM’s focus. “Quantum computing can be a pivotal pillar within the subsequent period of cybersecurity and computational innovation,” stated Doll, who can be becoming a member of IQM’s board as a part of the fundraise.

The truth that Ten Eleven Ventures has a robust community within the U.S. made it a robust match for the startup, Goetz stated.

The Collection B additionally noticed funding from Finnish funding agency Tesi, in addition to Schwarz Group, Winbond Electronics Company, EIC, Bayern Kapital, and World Fund. Per IQM, this new spherical brings its whole funding to this point to $600 million.

Goetz feels the scale of the spherical was justified by the business and technical milestones that the startup hit in the previous few months. “We at the moment are the corporate that has bought essentially the most quantum computer systems globally, in all main continents,” he stated.

In absolute numbers, that’s nonetheless small — in late 2024, the corporate hit a manufacturing milestone of 30 quantum computer systems. That solely serves to remind that the sector nonetheless has a protracted approach to go earlier than it reaches a wider viewers.

Nonetheless, IQM’s 54-qubit chips are already in use at computing facilities, analysis labs, universities, and enterprises, and Goetz stated that the corporate is now on monitor to deploying the primary 150-qubit programs — a undeniable fact that appears to matter rather more to him than IQM turning into a unicorn.