Nvidia CEO Jensen Huang, 62, has begun promoting Nvidia shares below a brand new buying and selling plan that enables him to get rid of as much as $865 million value of inventory by the top of the yr.

In keeping with a Monday submitting with the Securities and Alternate Fee, Huang offloaded 100,000 Nvidia shares, value $14.4 million, between Friday and Monday, his first sale of the yr. One other submitting reveals that Huang bought one other 50,000 shares on Monday, valued at over $7 million.

The transactions fall below a brand new 10b5-1 plan adopted on March 20 and disclosed final month in Nvidia’s quarterly report. The plan permits Huang to promote six million shares in complete by December 31, which might equal $865 million value of shares at Monday’s closing value of $144.17.

Associated: ‘The Decade of Autonomous Autos’: Nvidia CEO Predicts Main Development in Robotics, Self-Driving Vehicles

Nvidia’s quarterly report additionally revealed that the corporate’s Chief Monetary Officer, Colette M. Kress, and its Director, A. Brooke Seawell, additionally adopted 10b5-1 plans in March. Kress has the choice to promote 500,000 Nvidia shares by March 24, 2026, and Seawell can promote over 1.1 million shares by July 31.

Huang’s buying and selling plan provides him and different executives the choice to money in on inventory on a pre-arranged plan. Huang has bought greater than $1.9 billion in Nvidia shares up to now, per Bloomberg.

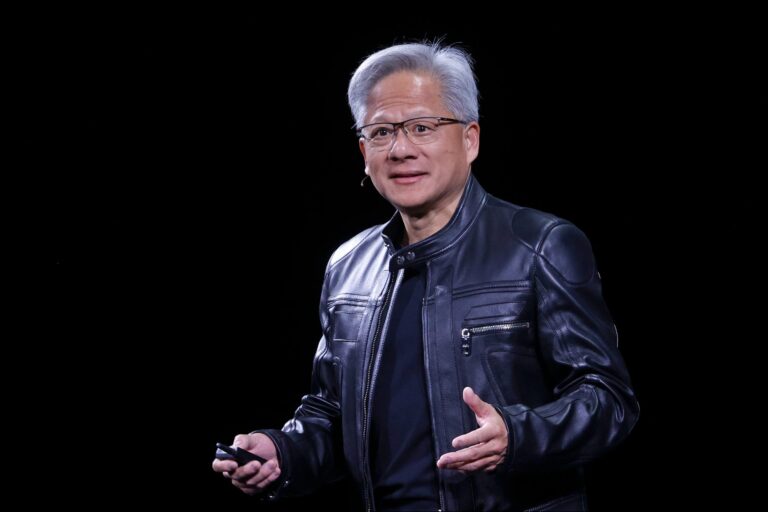

Nvidia co-founder and CEO Jensen Huang. Photograph by Chesnot/Getty Photographs

Huang is the twelfth richest individual on the planet, in response to the Bloomberg Billionaires Index, with a internet value of $126 billion on the time of writing. Most of his fortune, or about $124 billion value, consists of Nvidia shares, and the remainder is money. Huang, who co-founded Nvidia in 1993 and has been main it ever since, owns about 3.5% of the AI chipmaker as of March.

Associated: How Nvidia CEO Jensen Huang Remodeled a Graphics Card Firm Into an AI Big: ‘One of many Most Outstanding Enterprise Pivots in Historical past’

Nvidia lately reported robust earnings. For the primary quarter of fiscal yr 2026, ending April 27, the AI big reported income of $44.1 billion, up 12% from the earlier quarter and up 69% from the identical interval final yr. Nvidia expects income to be even increased for the second quarter of 2026, predicting $45 billion.

Nvidia shares have been climbing for the previous month and are up over 8%. The corporate is the No. 2 most dear on the planet, with a market capitalization of $3.58 trillion, second to Microsoft.

Nvidia CEO Jensen Huang, 62, has begun promoting Nvidia shares below a brand new buying and selling plan that enables him to get rid of as much as $865 million value of inventory by the top of the yr.

In keeping with a Monday submitting with the Securities and Alternate Fee, Huang offloaded 100,000 Nvidia shares, value $14.4 million, between Friday and Monday, his first sale of the yr. One other submitting reveals that Huang bought one other 50,000 shares on Monday, valued at over $7 million.

The transactions fall below a brand new 10b5-1 plan adopted on March 20 and disclosed final month in Nvidia’s quarterly report. The plan permits Huang to promote six million shares in complete by December 31, which might equal $865 million value of shares at Monday’s closing value of $144.17.

The remainder of this text is locked.

Be part of Entrepreneur+ immediately for entry.