Need extra housing market tales from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub e-newsletter.

When assessing house worth momentum, ResiClub believes it’s essential to observe lively listings and months of provide. If lively listings begin to improve quickly as houses stay available on the market for longer durations, it could point out pricing softness or weak point. Conversely, a fast decline in lively listings may recommend a market that’s heating up.

Because the nationwide Pandemic Housing Increase fizzled out in 2022, the nationwide energy dynamic has slowly been shifting directionally from sellers to patrons. After all, throughout the nation that shift has various considerably.

Usually talking, native housing markets the place lively stock has jumped above pre-pandemic 2019 ranges have skilled softer house worth development (or outright worth declines) over the previous 36 months. Conversely, native housing markets the place lively stock stays far beneath pre-pandemic 2019 ranges have, usually talking, skilled extra resilient house worth development over the previous 36 months.

The place is nationwide lively stock headed?

Nationwide lively listings are on the rise on a year-over-year foundation (+15% from October 2024 to October 2025). This means that homebuyers have gained some leverage in lots of components of the nation over the previous 12 months. Some vendor’s markets have was balanced markets, and extra balanced markets have was purchaser’s markets.

Nationally, we’re nonetheless beneath pre-pandemic 2019 stock ranges (9% beneath October 2019) and a few resale markets, specifically chunks of the Midwest and Northeast, nonetheless stay tight-ish.

Whereas nationwide lively stock remains to be up 12 months over 12 months, the tempo of development has slowed in latest months—greater than typical seasonality would recommend—as some sellers have thrown within the towel and delisted in weak/tender markets.

October stock/lively listings* whole, in accordance with Realtor.com:

- October 2017 -> 1,287,322 📉

- October 2018 -> 1,304,682 📈

- October 2019 -> 1,208,311 📉

- October 2020 -> 734,040 📉

- October 2021 -> 565,707 📉 (overheating in the course of the Pandemic Housing Increase)

- October 2022 -> 752,741 📈

- October 2023 -> 738,082 📉

- October 2024 -> 953,814 📈

- October 2025 -> 1,100,001 📈

If we preserve the present year-over-year tempo of stock development (+146,187 houses on the market), we’d have 1,246,188 lively stock come October 2026.

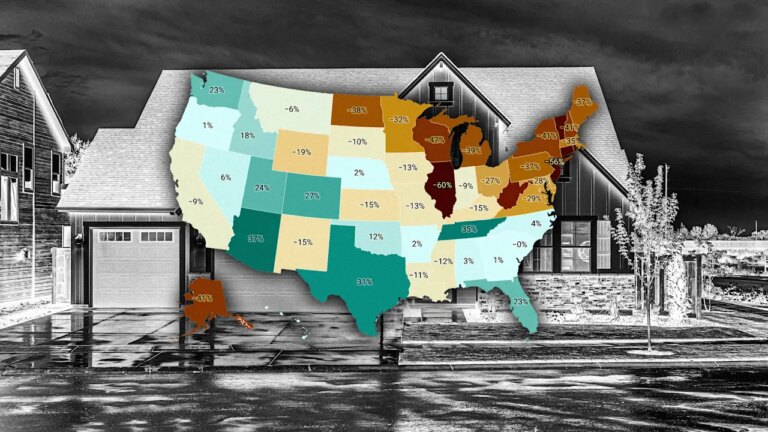

Beneath is the year-over-year lively stock share change by state.

window.addEventListener(“message”,perform(a){if(void 0!==a.knowledge[“datawrapper-height”]){var e=doc.querySelectorAll(“iframe”);for(var t in a.knowledge[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.supply){var d=a.knowledge[“datawrapper-height”][t]+”px”;r.fashion.peak=d}}});

Whereas lively housing stock is rising in most markets on a year-over-year foundation, some markets nonetheless stay tight-ish (though it’s loosening in these locations too).

As ResiClub has been documenting, each lively resale and new houses on the market stay probably the most restricted throughout enormous swaths of the Midwest and Northeast. That’s the place house sellers subsequent spring are prone to have extra energy, comparatively talking.

In distinction, lively housing stock on the market has neared or surpassed pre-pandemic 2019 ranges in lots of components of the Sunbelt and Mountain West, together with metro-area housing markets akin to Punta Gorda, Florida, and Austin.

Many of those areas noticed main worth surges in the course of the Pandemic Housing Increase, with house costs getting stretched in comparison with native incomes. As pandemic-driven home migration slowed and mortgage charges rose, markets like Tampa and Austin confronted challenges, counting on native revenue ranges to assist frothy house costs.

This softening pattern was accelerated additional by an abundance of recent house provide within the Sunbelt. Builders are sometimes prepared to decrease costs or provide affordability incentives (if they’ve the margins to take action) to keep up gross sales in a shifted market, which additionally has a cooling impact on the resale market: Some patrons who would have beforehand thought-about present houses at the moment are choosing new houses with extra favorable offers. That places extra upward stress on resale stock.

window.addEventListener(“message”,perform(a){if(void 0!==a.knowledge[“datawrapper-height”]){var e=doc.querySelectorAll(“iframe”);for(var t in a.knowledge[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.supply){var d=a.knowledge[“datawrapper-height”][t]+”px”;r.fashion.peak=d}}});

On the finish of October 2025, 17 states had been above pre-pandemic 2019 lively stock ranges: Alabama, Arkansas, Arizona, Colorado, Florida, Georgia, Hawaii, Idaho, Nebraska, Nevada, North Carolina, Oklahoma, Oregon, Tennessee, Texas, Utah, and Washington. (The District of Columbia—which we not noted of this evaluation—can be again above pre-pandemic 2019 lively stock ranges. Softness in D.C. correct predates the present admin’s job cuts.)

window.addEventListener(“message”,perform(a){if(void 0!==a.knowledge[“datawrapper-height”]){var e=doc.querySelectorAll(“iframe”);for(var t in a.knowledge[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.supply){var d=a.knowledge[“datawrapper-height”][t]+”px”;r.fashion.peak=d}}});

Huge image: Over the previous few years we’ve noticed a softening throughout many housing markets as strained affordability tempers the fervor of a market that was unsustainably scorching in the course of the Pandemic Housing Increase. Whereas house costs are falling some in pockets of the Sunbelt, an enormous chunk of Northeast and Midwest markets nonetheless eked out slightly worth appreciation this spring. Nationally aggregated house costs have been fairly near flat in 2025.

Beneath is one other model of the desk above—however this one consists of each month since January 2017.

window.addEventListener(“message”,perform(a){if(void 0!==a.knowledge[“datawrapper-height”]){var e=doc.querySelectorAll(“iframe”);for(var t in a.knowledge[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.supply){var d=a.knowledge[“datawrapper-height”][t]+”px”;r.fashion.peak=d}}});