Buyers in quantum computing shares are having one other nice week, with shares within the main publicly traded companies up by double digits during the last 24 hours normally. Right here’s a snapshot of their single-day development as of the closing bell on Thursday:

- Rigetti Computing (Nasdaq: RGTI): Up 18.25%

- D-Wave Quantum Inc (NYSE: QBTS): Up 13.97%

- IONQ Inc (NYSE: IONQ): Up 10.32%

- Quantum Computing Inc (Nasdaq: QUBT): 5;32%

All 4 firms had been additionally up in premarket buying and selling on Friday as of this writing.

Why are quantum computing shares rising this week?

The rally is seemingly being led partly by Berkeley, California-based Rigetti, which introduced a serious buy order on Tuesday for 2 of its 9-qubit Novera quantum computing techniques, that are utilized in analysis and improvement.

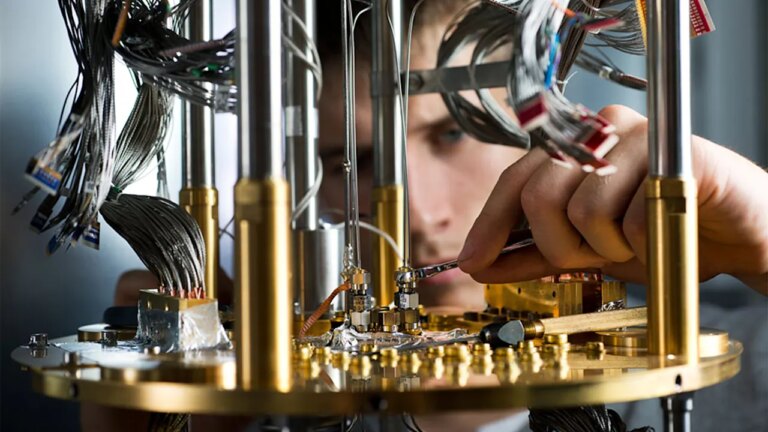

Rigetti launched the techniques in 2023 and says they’re upgradable, which means the qubit depend might be elevated. Qubits, or quantum bits, are the essential items on which quantum computer systems function.

Supply of Rigetti’s two techniques are anticipated by early subsequent yr. The acquisition order totaled $5.7 million, the corporate stated.

Whereas that may not seem to be an enormous sum, it’s one other signal that any individual, someplace sees sensible makes use of for quantum computing know-how, which has remained largely theoretical till comparatively lately. Rigetti didn’t say who bought the techniques, solely that one buyer was an Asian firm that builds manufacturing tech and the opposite was an AI startup based mostly in California.

Craig Ellis, an analyst at B. Riley Monetary, additionally lately reiterated his Purchase ranking for Rigetti, as Motley Idiot reported.

Along with Rigetti’s announcement, D-Wave introduced the outcomes of a “proof-of-technology” joint mission with the North Wales Police within the U.Ok. The mission leveraged hybrid quantum know-how to assist optimize the location of police automobiles.

“The hybrid-quantum know-how delivered a quicker, extra correct, and extra environment friendly resolution than classical strategies alone, offering NWP with the flexibility to cut back the typical incident response time by almost 50%,” D-Wave stated in its press launch.

Quantum computing shares have had a wild experience this yr

Publicly traded quantum computing companies started to captivate buyers late final yr as stories of the know-how’s potential capabilities began to make headlines.

Rigetti, which was basically a penny inventory one yr in the past, has seen its shares enhance by a staggering 4,620% during the last 12 months. The inventory was buying and selling at $35.40 a share as of Thursday’s shut.

D-Wave, whose CEO has vocally pushed again towards claims that industrial quantum computer systems are nonetheless a long time away, has likewise seen its shares rise by 3,075% over that very same interval.

Ought to such wild development give buyers pause? Nicely, in all probability. Though many specialists consider that quantum computing is a bonafide technical revolution that would remodel the business and the world, the sector stays extremely speculative at current. It’s not onerous to search out critics who contend that these shares are overvalued. Time will inform.