Redwire most likely is not a purchase proper now. However that does not essentially make it a promote.

Shares of Redwire Company (RDW -11.83%), a builder of orbital area infrastructure, took an incredible hit on Wednesday morning, falling 11.9% via 9:55 a.m. ET — all apparently on no information.

Or no less than on no unhealthy information.

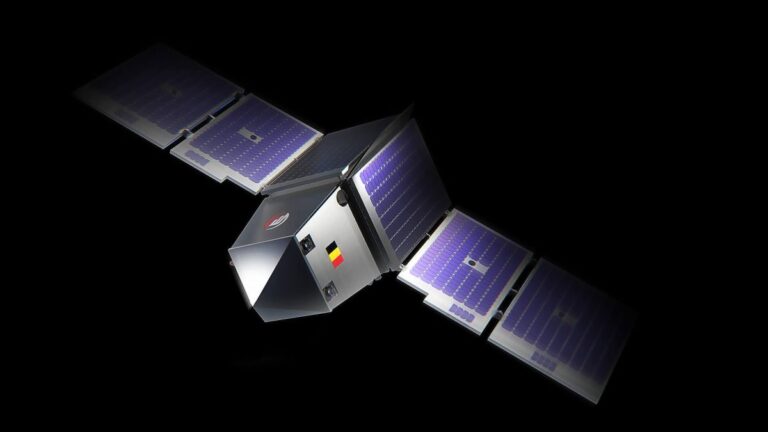

Picture supply: Redwire.

Redwire’s excellent news week

On the contrary, two days in the past, Redwire introduced it’ll companion with industrial big Honeywell (HON 1.18%) “to discover alternatives to mature and increase the usage of quantum key distribution know-how for civil and protection prospects.”

(That is proper of us, greater than only a area inventory, Redwire now says it is a quantum computing inventory, too.)

Then, simply yesterday, Redwire introduced a second partnership, this time with European aerospace big Thales-Alenia, to turn out to be the prime contractor on the European House Company’s Skimsat, a know-how demonstration mission launching a small satellite tv for pc into very low earth orbit (VLEO). Redwire will supply up its personal Phantom spacecraft to function a guinea pig for the mission.

Is Redwire inventory a promote?

As you may count on, Redwire inventory has been progressively rising all week lengthy as the nice PR bulletins rolled in. Why it is taken a sudden nosedive as we speak — on no information — is tougher to elucidate.

However I can strive.

Neither of Redwire’s PR releases, in spite of everything, talked about what income is likely to be produced the corporate. Neither gave any indication that the brand new partnerships will materially transfer Redwire nearer to profitability. On the contrary, most analysts polled by S&P International Market Intelligence suppose will probably be 2027 earlier than Redwire has any hope of starting to earn earnings for its shareholders.

That is not essentially a motive to hurry out and promote Redwire inventory proper now. However it’s additionally not a fantastic foundation for purchasing the inventory.

Wealthy Smith has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a disclosure coverage.