As if there wasn’t sufficient consolidation in company land — and {the marketplace} confusion that comes with it — this week goes to be one other game-changer as Cindy Rose formally takes over operating WPP and Dentsu formalizes its intent to get out of the worldwide holding firm race.

Rose’s alternatives and challenges are being addressed in one other story we’re publishing immediately, so immediately the main target is on Dentsu, which for the final decade or extra has operated as one of many Massive Six holdcos, alongside WPP, Publicis, Havas, and Omnicom and IPG (the latter two quickly to turn into one, barring unexpected obstacles).

In its second-quarter earnings assertion, Dentsu’s CEO Hiroshi Igarashi declared his intent to discover a purchaser for all of the holdco’s belongings exterior of Japan, which is its personal fiefdom and has at all times been saved separate from the remainder of Dentsu. Hiring Morgan Stanley and Nomura Securities, it interprets to placing the previous holdco Aegis holdings up on the market. Igarashi-san instructed analysts on Dentsu’s newest earnings name that “[the] worldwide enterprise continues to face destructive progress throughout all areas, leading to a difficult general efficiency.”

What are the strengths and weaknesses of those holdings? Who’re the potential consumers? And what does that do to the ability stability among the many holdcos? We’ll attempt to supply some insights if not solutions (since nobody but is aware of what’s going to ensue).

What’s on the market and what worth does it have?

Whereas WPP’s woes, Publicis’ progress, Havas’ public spinoff from mum or dad Vivendi and the IPG-Omnicom merger have every hogged headlines, Dentsu’s underperforming worldwide companies have flown underneath the radar in recent times. Alongside the way in which, they picked up companies which have worth in immediately’s market, specifically Merkle, which Dentsu purchased again in 2018. And regionally, a few of Dentsu’s media businesses have carried out effectively, together with Carat and iProspect (much less so Dentsu X, which simply misplaced its U.S. CEO Leah Meranus to Publicis).

However the holdco has endured a collection of restructuring schemes that began in 2019 and are nonetheless ongoing immediately (the latest section included a 8% international headcount lower); cultural initiatives designed to export Japanese company sensibilities and vocabulary to its international places of work; and a collection of main acquisitions, together with the takeover of Merkle.

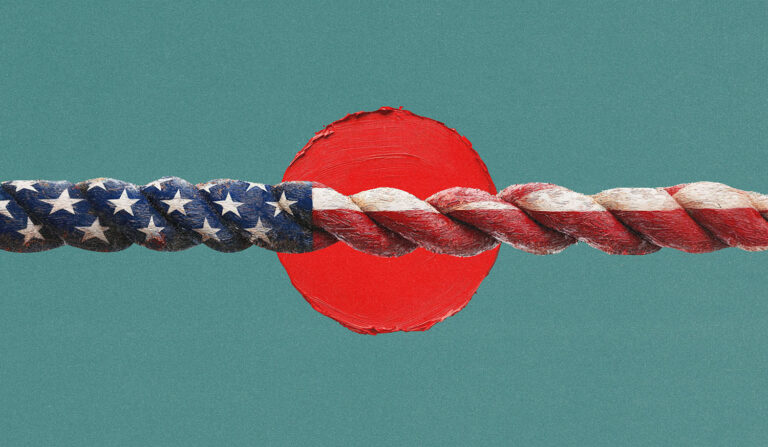

The corporate has needed to climate fixed inner tensions between the poles of Manhattan and Tokyo. U.S. leaders perennially (and principally privately) complained that decision-making energy was targeting the opposite facet of the globe. When worldwide CEO Wendy Clark abruptly left the enterprise in 2022, it appeared affirmation that Igarashi’s endurance was operating skinny; ever since there’s been a veritable conga line of leaders which have come and gone, together with Clark’s substitute Michael Komasinski.

“The concept of ‘One Dentsu in Japan coming along with the community, it wasn’t ever actual,” acknowledged a Dentsu insider. “They by no means wished the 2 companies to be collectively. In the event that they did, they might have made the APAC area inclusive of Japan.”

Most analysts Digiday spoke with agree the holdings on the block will doubtless be bought in entirety moderately than in items, primarily as a result of the media belongings, together with the tech stack, have extra worth to a suitor. “Dentsu’s tech stack, it positively matches and Merkle is pretty much as good technically as any of the holdcos,” stated Ryan Kangisser, chief technique officer at MediaSense. “However by way of their working methods and funding in tech, it’s not on the similar degree of the others.”

“Dentsu’s media enterprise is a powerful media participant within the market — it’s effectively portfolio’d,” agreed Jay Pattisall, vp and senior company analyst at Forrester. “The gem of it’s its media activation expertise that leverages Merkle’s Mercury platform.”

So who may be a purchaser?

Chatting with a variety of analysts, potential suitors embody Havas, Accenture, WPP and, crazily sufficient, even Meta — which it’s no secret is attempting its finest to get advertisers to avoid businesses and spend immediately inside its platform. (Google’s not far off from its intentions, however is unlikely to make a transfer for a holding firm when it’s nonetheless combating off governmental authorized circumstances.)

“Think about Meta having the ability to supply Meta knowledge throughout Whatsapp and Fb and Instagram … that could possibly be their model of Epsilon, and far stronger, as a result of it isn’t second social gathering or third social gathering knowledge, it’s first social gathering knowledge,” stated Ruben Schreurs, group CEO at Ebiquity. He additionally famous that, though personal fairness is circling lots of businesses and company teams like sharks round a sunken ship, it’s unlikely PE would swoop in right here, provided that these are components moderately than an entire asset.

Amongst holdcos and advertising companies companies which can be potential consumers, Havas tops the record. For one, Yannick Bolloré has been vocal about being acquisitive — and for an additional, the transfer would give it a a lot stronger European and North American foothold, if it needs to actually compete with WPP, Publicis and a merged Omnicom/IPG.

However Accenture as a purchaser makes lots of sense to Ebiquity’s Schreurs. “Little or no of [Accenture Song] is media, so they aren’t successful these like built-in accounts like Mars,” he stated. “They’re not thought-about as a result of their lack by way of media activation functionality worldwide. They’re nice on technique and transformation and manufacturing, and now with AI, they’ve a very sturdy positioning there, however the media activation half is the piece that’s lacking.”

Stagwell, Horizon Media and others have all been steered as attainable consumers, with Merkle because the carrot on the finish of the stick. However to Brian Wieser, longtime media analyst, perhaps nobody is the precise purchaser. “There’s so many prospects, and none of them are additionally prospects, which means it could possibly be that nobody needs to purchase on the worth that Dentsu needs,” stated Wieser. “Are you able to make a case for any of a dozen totally different attainable acquirers or situations? Certain, however there’s nobody situation that appears extra doubtless than every other.”

The stability of energy

In the long run, Dentsu’s intent to promote might upset the hierarchy of holdcos because it presently stands — present king of the hill Publicis, soon-to-be-biggest OmniPublic, recovering WPP. All of them might face better competitors if any of the above situations involves go.

Colour by numbers

Entrepreneurs have a unending fascination with and want to succeed in Gen Z, and more and more, Gen Alpha, in hopes of successful their consideration and loyalty. Video ad-tech platform PreciseTV conducts an annual report on the cohort, dubbed PARTY — Exact Advertiser Report: Teenagers & Youth — to determine how teenagers 13-17 (with enter from their mother and father) devour content material, have interaction with adverts and now more and more use AI instruments. Right here’s what it discovered:

- 69% of U.S. teenagers use AI platforms, with ChatGPT being probably the most used, adopted by Google Gemini;

- 91% of teenagers watch YouTube, the preferred platform amongst all codecs — that’s an 18% raise over 2024;

- 67% of oldsters and 38% of teenagers recall seeing their final purchase-driving advert on YouTube.

Takeoff & touchdown

- In what was a comparatively quiet week in account strikes earlier than the Labor Day lengthy weekend, VaynerMedia consolidated media AOR duties for tax consultancy H&R Block, from social media and inventive.

- In what represents the tip of the upfront market, Amazon final week stated it wrapped its upfront gross sales, saying it exceeded its expectations (however providing no numbers to assist that sentiment).

- Personnel strikes: Dentsu named Kyla Jeffers as its first-ever chief progress officer for North America, coming over from WPP the place she was evp of worldwide progress and advertising answerable for the Coca-Cola account … Noble Individuals employed Ben Hurst to be its president, coming over from on-line betting agency Evoke, the place he was vp of technique and operations … Brainlabs employed former Monks head of efficiency media Adam Edwards as chief product officer.

Direct quote

“An under-discussed matter on this enterprise is, once you’re leveraging all this knowledge and doing all these items, how a lot are you including to the worth — to the purpose the place the payout isn’t proportionally associated to the rise to what you’d have accomplished at a decrease price? … What usually will get talked about within the business is, higher concentrating on is healthier universally. Theoretically that’s proper. However at what price? The fee is part of that equation, proper? It could possibly’t be dismissed wholly. That’s the place we have to [find] stability.”

— Swapnil Patel, co-president of Consideration Arc, the newly merged media company that’s a part of Cheil Company Community.