Nvidia, the world’s Most worthy firm, reported one other quarter of sustained gross sales progress in its earnings assertion Wednesday, with $46.7 billion in income, a 56% improve in comparison with the identical interval final 12 months. That progress was largely fueled by AI-dominated knowledge middle enterprise, which noticed a 56% year-over-year improve in income.

Nvidia additionally noticed its web revenue develop considerably since final 12 months. The corporate reported a web revenue of $26.4 billion within the second quarter, a 59% spike for the reason that similar interval final 12 months.

All instructed, the corporate introduced in $41.1 billion in income from knowledge middle gross sales within the quarter, suggesting that AI corporations’ demand for cutting-edge GPUs continues to develop. The corporate’s most superior technology of chips, Blackwell, accounted for $27 billion of these gross sales.

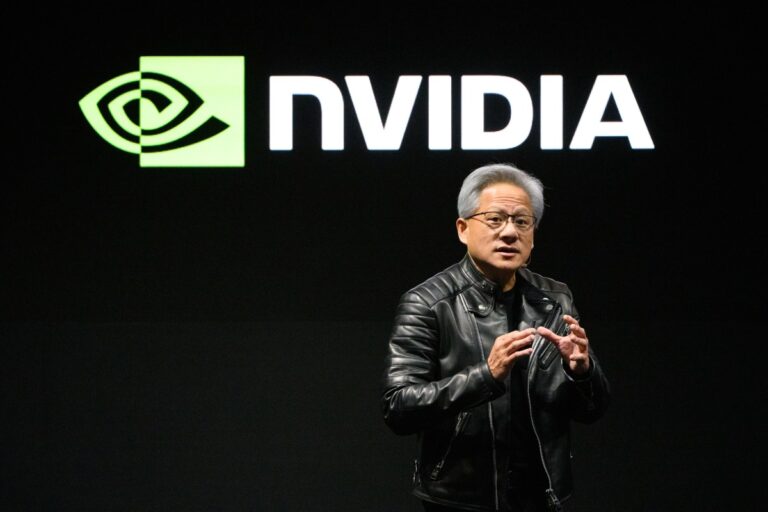

“Blackwell is the AI platform the world has been ready for,” stated CEO Jensen Huang in a press release accompanying the discharge. “The AI race is on, and Blackwell is the platform at its middle.”

Huang stated that the corporate expects to see $3 to 4 trillion in AI infrastructure spending by the top of the last decade. “$3 to 4 trillion is pretty smart for the subsequent 5 years,” he instructed one analyst.

The corporate made explicit notice of its position within the launch of OpenAI’s open supply gpt-oss fashions earlier this month, which concerned processing “1.5 million tokens per second on a single Nvidia Blackwell GB200 NVL72 rack-scale system.”

The earnings additionally gave a have a look at Nvidia’s ongoing battle to promote its chips in Chinese language markets. The corporate reported no gross sales of its China-focused H20 chip to Chinese language clients previously quarter; Nvidia did report $650 million price of H20 chips had been bought to a buyer exterior China.

Techcrunch occasion

San Francisco

|

October 27-29, 2025

America has lengthy restricted gross sales of superior GPUs to Chinese language clients — however the geopolitical state of affairs has modified considerably beneath President Trump. The corporate is now permitted to promote chips to China so long as it pays a 15% export tax to the U.S. Treasury, because of an unconventional association that authorized students have described as an unconstitutional abuse of energy.

On the earnings name, Nvidia CFO Colette Kress made clear that the dearth of cargo was a results of uncertainty across the association, which has not been formally codified right into a federal regulation. “Whereas a choose variety of our China-based clients have acquired licenses over the previous few weeks,” Kress stated, “we’ve not shipped any H20 gadgets based mostly on these licenses.”

Nonetheless, the Chinese language authorities has formally discouraged the usage of Nvidia chips by native companies, main the corporate to reportedly halt manufacturing of the H20 chip earlier this month.

Nvidia stated it expects $54 billion in income within the third quarter. The corporate famous that its outlook for the third quarter, which may shift 2% in both path, doesn’t embody any H20 shipments to China.