Annaly Capital Administration (NLY 0.91%) has an ultra-high 14%-plus dividend yield. Toronto-Dominion Financial institution (TD 0.71%) has a yield of “simply” 4.1%. In some methods, these two dividend shares aren’t even taking part in in the identical league. Certainly, if dividend reliability and dividend progress are essential to you then you definately’ll undoubtedly be higher off with Toronto-Dominion Financial institution.

This is what you must know.

Picture supply: Getty Photographs.

What backs up Annaly Capital Administration’s large yield?

Annaly Capital is what is named a mortgage-focused actual property funding belief (REIT). It buys mortgages which were pooled collectively into bond-like securities. This can be a distinctive area of interest of the general REIT sector and Annaly Capital is extra like a mutual fund than a landlord. The aim is to make the distinction between the curiosity Annaly earns and its working prices, which notably embrace the price of debt.

Annaly is definitely a superbly effective mortgage REIT. And it has a large dividend yield, as famous above. However do not let that yield distract you from one essential reality. Annaly is a complete return funding, which requires dividend reinvestment. In the event you spend your dividends right here you’ll possible find yourself being very disillusioned. That is as a result of Annaly has an extended historical past of slicing its dividend. And the share worth tends to comply with together with the dividend, going up and down together with the course of dividend adjustments.

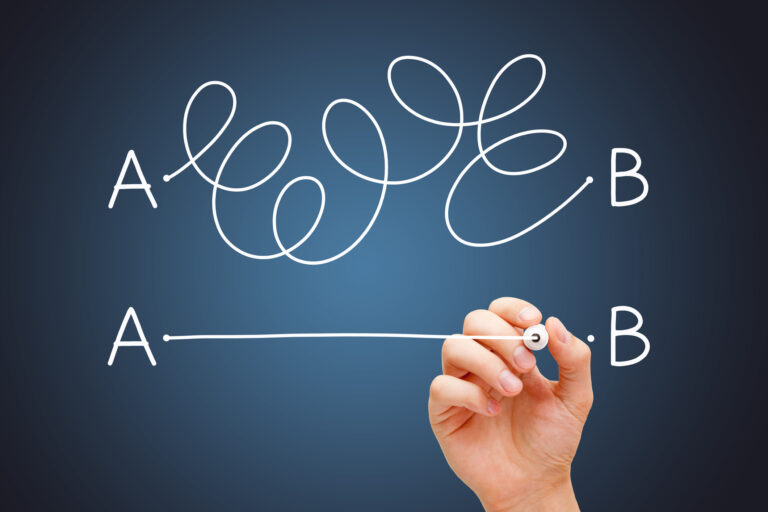

The graph beneath summarizes a number of info. Discover that whole return (the blue line) is fairly spectacular. However the dividend (the orange line) and the inventory worth (the purple line) have been very unstable. Certain, the yield in the present day is big. However in the event you spend that dividend as a substitute of reinvesting it, effectively, historical past means that your end result right here most likely will not be superb.

NLY information by YCharts

Toronto-Dominion Financial institution is a dependable dividend inventory

Evaluate the volatility with Annaly to the steadiness supplied by Toronto-Dominion Financial institution. Through the Nice Recession, when a number of the largest U.S. banks have been compelled to chop their dividends, TD Financial institution, as it’s extra generally identified, held its dividend regular.

Even when TD Financial institution’s U.S. arm was discovered to have laundered cash and regulators hit the financial institution with a big effective and an asset cap, TD Financial institution elevated its dividend regardless of the enterprise setback. The truth is, TD Financial institution has reliably paid a dividend since 1857.

So whereas the yield is decrease, at 4.1%, than Annaly affords, buyers can go in with extra confidence that the dividend will likely be paid on the identical price, and even larger. That 4.1% yield, by the way in which, is effectively above the two.6% yield of the common U.S. financial institution and effectively above the 1.3% yield supplied by the S&P 500 in the present day. So whereas TD Financial institution is not providing a 14%-plus yield, the payout remains to be comparatively engaging.

There are a few key elements to think about right here. TD Financial institution hails from Canada, the place banking laws are notably strict. That has resulted in a conservative ethos inside the banking sector, and inside TD Financial institution. The regulation in Canada has additionally resulted in entrenched positions for the biggest banks, of which TD Financial institution is one. Thus, TD Financial institution’s basis right here is extremely sturdy.

The time to purchase TD Financial institution is now

TD Financial institution’s inventory has truly carried out pretty effectively not too long ago as buyers have turn into much less involved in regards to the regulatory subject famous above. Nevertheless, given the comparatively excessive yield it’s nonetheless a robust dividend possibility.

So in the event you have been contemplating taking over the chance of Annaly Capital’s enterprise mannequin, you may truly be higher off taking over TD Financial institution and its regulatory danger subject. Sure, the yield is decrease, however in case you are attempting to stay off of the earnings your portfolio generates, still-out-of-favor TD Financial institution is the stronger long-term possibility.