Need extra housing market tales from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub e-newsletter.

Talking to analysts final month, Lennar co-CEO Jon Jaffe affirmed what different big homebuilders have been saying all 12 months: This 12 months’s housing market was weaker than they anticipated.

“All the markets we function in skilled some stage of softening [this quarter]. Even in our strongest performing markets, patrons wanted the help of incentives. Incentives will range throughout the totally different markets, however primarily within the type of help with mortgage fee buydowns,” Jaffe mentioned. “The markets that skilled tougher circumstances [for Lennar] throughout the quarter have been the Pacific Northwest markets of Seattle and Portland; the Northern California markets of the Bay Space and Sacramento; the Southwestern markets of Phoenix, Las Vegas, and Colorado; and a few Japanese markets comparable to Raleigh, Atlanta, and Jacksonville.”

To draw sidelined patrons, in Q2 2025, Lennar—America’s second-largest homebuilder—spent a median of 13.3% of the ultimate gross sales value on gross sales incentives, comparable to mortgage fee buydowns. At that incentive fee, a house with a $450,000 sticker value would include practically $60,000 in incentives. In accordance with John Burns Analysis and Consulting, that’s the best incentive stage Lennar has supplied since 2009—and it’s considerably increased than Lennar’s cycle low in Q2 2022, when it spent 1.5% of the ultimate gross sales value on gross sales incentives.

The longer we’ve stayed on this softer housing demand surroundings—which has been the case since mortgage charges spiked and the pandemic housing growth fizzled out in summer time 2022—the extra that unsold new-build stock has ticked up. Certainly, for the reason that pandemic housing growth fizzled out, the variety of unsold, accomplished new single-family houses within the U.S. has been rising:

Might 2018 —> 59,000

Might 2019 —> 79,000

Might 2020 —> 74,000

Might 2021 —> 33,000

Might 2022 —> 36,000

Might 2023 —> 65,000

Might 2024 —> 93,000

Might 2025 —> 119,000

The Might determine (119,000 unsold, accomplished new houses) revealed final week is the best stage since July 2009 (126,000).

Let’s take a more in-depth take a look at the information to raised perceive what this might imply.

!operate(){“use strict”;window.addEventListener(“message”,operate(a){if(void 0!==a.knowledge[“datawrapper-height”]){var e=doc.querySelectorAll(“iframe”);for(var t in a.knowledge[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.supply){var d=a.knowledge[“datawrapper-height”][t]+”px”;r.type.peak=d}}})}();

To place the variety of unsold, accomplished new single-family houses into historic context, we created a brand new index: ResiClub’s Completed Properties Provide Index.

The index is one easy calculation: The variety of unsold, accomplished U.S. new single-family houses divided by the annualized fee of U.S. single-family housing begins. A better index rating signifies a softer nationwide new building market with better provide slack, whereas a decrease index rating signifies a tighter new building market with much less provide slack.

In case you take a look at unsold, accomplished single-family new builds as a share of single-family housing begins (see chart under), it nonetheless reveals we’ve gained slack; nonetheless, it places us nearer to pre-pandemic 2019 ranges than the Nice Monetary Disaster bust.

!operate(){“use strict”;window.addEventListener(“message”,(operate(a){if(void 0!==a.knowledge[“datawrapper-height”]){var e=doc.querySelectorAll(“iframe”);for(var t in a.knowledge[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.supply){var d=a.knowledge[“datawrapper-height”][t]+”px”;r.type.peak=d}}}))}();

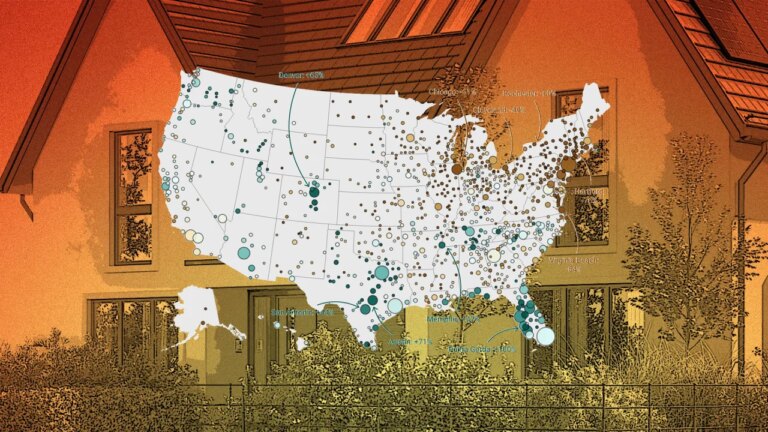

Whereas the U.S. Census Bureau doesn’t give us a better market-by-market breakdown on these unsold new builds, we now have a good suggestion the place they’re, based mostly on the place whole energetic stock of houses on the market (together with current) has spiked above pre-pandemic 2019 ranges. Most of these areas are within the Solar Belt across the Gulf.

Builders are dealing with pricing strain—particularly in pockets of the Solar Belt the place energetic housing stock on the market is nicely above pre-pandemic 2019 ranges.

!operate(){“use strict”;window.addEventListener(“message”,(operate(a){if(void 0!==a.knowledge[“datawrapper-height”]){var e=doc.querySelectorAll(“iframe”);for(var t in a.knowledge[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.supply){var d=a.knowledge[“datawrapper-height”][t]+”px”;r.type.peak=d}}}))}();