Need extra housing market tales from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub publication.

Heading into the yr, Zillow economists forecasted that U.S. house costs have been more likely to rise 2.6% in 2025.

Nonetheless, this yr, the housing market—particularly within the Solar Belt—was softer than anticipated and Zillow has made a number of downgrades to its forecast for nationwide house costs.

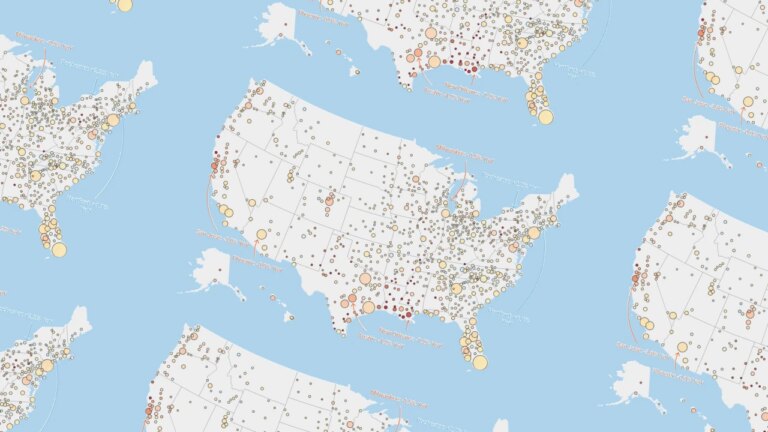

This week, newly launched information from Zillow reveals that U.S. house costs have decelerated to a year-over-year improve of simply 0.4%. Zillow economists now anticipate U.S. house costs to say no by 0.7% between Might 2025 and Might 2026.

“With stock up almost 20% over the earlier yr, consumers had extra choices in Might than at any time since July 2020. Regardless of increased gross sales, sellers nonetheless outnumber consumers,” wrote Zillow economists. “This offers consumers extra time to determine and extra energy in negotiations. Zillow’s market warmth index reveals a balanced market nationwide, one which’s much more buyer-friendly than in recent times. Competitors amongst consumers declined to the bottom stage seen in Might in Zillow data, reaching again by means of 2018.”

Not solely do Zillow economists predict comfortable nationwide house value progress this yr, however they’re additionally predicting that the housing market will solely see 4.1 million U.S. present house gross sales in 2025. That will mark the third-straight yr of suppressed present house gross sales. For comparability, in pre-pandemic 2019, there have been 5.3 million present house gross sales within the U.S.

Zillow economists added: “House values have fallen in 22 of the 50 largest metro areas over the previous yr, and sellers reduce costs on virtually 26% of listings nationwide—one other Might excessive in Zillow data. Properties that promote usually achieve this in 17 days, about 4 greater than final yr and solely two days fewer than pre-pandemic averages.”

!operate(){“use strict”;window.addEventListener(“message”,(operate(a){if(void 0!==a.information[“datawrapper-height”]){var e=doc.querySelectorAll(“iframe”);for(var t in a.information[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.supply){var d=a.information[“datawrapper-height”][t]+”px”;r.fashion.peak=d}}}))}();

Among the many 300 largest U.S. housing markets, Zillow expects the strongest house value appreciation between Might 2025 and Might 2026 to happen in these 10 areas:

- Atlantic Metropolis, New Jersey → 3.4%

- Kingston, New York → 2.7%

- Knoxville, Tennessee → 2.6%

- Pottsville, Pennsylvania → 2.5%

- Torrington, Connecticut → 2.4%

- Rochester, New York → 2.2%

- Syracuse, New York → 2.1%

- Fayetteville, Arkansas → 2.1%

- Rockford, Illinois → 2.1%

- Yuma, Arizona → 2.0%

Among the many 300 largest U.S. housing markets, Zillow expects the weakest house value appreciation between Might 2025 and Might 2026 to happen in these 10 areas:

- Houma, Louisiana → -9.4%

- Lake Charles, Louisiana → -8.9%

- New Orleans → -7.2%

- Alexandria, Louisiana → -6.7%

- Lafayette, Louisiana → -6.6%

- Shreveport, Louisiana → -6.4%

- Beaumont, Texas → -6.2%

- San Francisco → -5.5%

- Midland, Texas → -5.3%

- Odessa, Texas → -5.3%

Whereas Zillow expects house costs throughout most of Florida to be flat over the approaching yr, ResiClub stays skeptical. In spite of everything, Florida has skilled a big improve in lively stock and months of provide over the previous yr, which may sign potential pricing weak point. Certainly, costs of single-family houses and condos are at the moment declining in most Florida housing markets.