The economic sector is outpacing the S&P 500 — listed here are two firms to look at.

After a sleepy 2024, industrial shares have been on a tear this 12 months. The Industrial Choose Sector SPDR exchange-traded fund (ETF) is up over 15%. At that price, it is outpacing the S&P 500‘s acquire of about 10%, making it one in every of highest sector performers in 2025.

Why are industrials performing so effectively? Couple of causes. First, synthetic intelligence (AI) infrastructure spending is booming. Information facilities want industrial merchandise, like generators, HVAC programs, and transformers, that solely industrial firms could make at scale.

Second, aerospace and protection shares are having one in every of their greatest years. World protection budgets have been surging, with demand for civil and protection aviation outpacing provide. Throw in main infrastructure investments on the federal degree — just like the Infrastructure Funding and Jobs Act (IIJA) — and industrials are clearly propped up by all kinds of tailwinds.

That does not imply each industrial inventory is a win. Industrials are usually cyclical, and one have to be cautious to not purchase when an organization’s earnings are about to peak. As I scan the panorama of commercial firms, these two stick out as alternatives now.

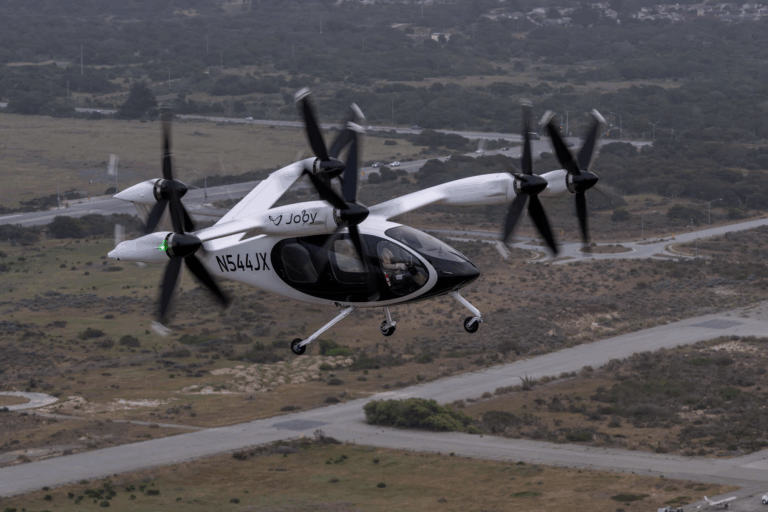

Joby Aviation

Joby Aviation (JOBY 0.46%) has been one of many top-performing industrial shares in 2025. Certainly, as of this writing (Sept. 1), share costs have climbed virtually 75% 12 months thus far, which tops the S&P 500 by an extended shot, in addition to the -6.5% year-to-date lack of its rival Archer Aviation.

Picture supply: Joby Aviation.

Joby is a pioneer within the electrical vertical take-off and touchdown (eVTOL) business. Its manufacturing prototype is the S4, an all-electric plane that may maintain 4 passengers and fly as much as about 150 miles earlier than it wants a brand new cost. The S4 is quieter than a helicopter, produces no emissions, and will assist alleviate one of many peskiest issues in city transportation: gridlocked visitors alongside congested roads.

The full addressable market (TAM) for city air mobility is predicted to be about $9 trillion in 2050, in keeping with analysts at Morgan Stanley. Joby is at present value about $12 billion. If it could possibly seize a portion of that market, the expansion alternative might be staggering.

However let’s not get too enthusiastic right here. The fact is that Joby is not making significant income — but. Final quarter, it introduced in about $15,000, primarily none, and incurred a internet lack of $325 million. It nonetheless hasn’t handed the regulatory hurdles imposed by the Federal Aviation Administration (FAA), which implies its money place — about $991 million on the finish of the second quarter — is one thing buyers ought to watch carefully.

On the identical time, Joby is making progress. In mid-August 2025, Joby flew an eVTOL craft efficiently between two U.S. public airports in Marina and Monterey, California. It is also about 70% completed on its aspect of stage 4 FAA-type certification. And at last it accomplished its acquisition of Blade Air Mobility, which presents it a community of terminals in key markets like New York.

Once more, nothing is fastened, and Joby nonetheless has an extended solution to go earlier than it is taxiing prospects between vertiports. However for development inventory buyers who can abdomen volatility, a $100 funding on this eVTOL inventory might go a great distance down the street.

Caterpillar

You’ve got in all probability seen a Caterpillar (CAT 1.33%) machine in some unspecified time in the future in your life. Large yellow claw digging holes or flattening grime for roads. It is a family identify — a model on T-shirts and children’ toys — but that is not the explanation why it is value a $100 funding at present.

That motive has to do with synthetic intelligence (AI). Though Caterpillar is greatest identified for its industrial and mining tools, it additionally makes tools for energy technology and backup energy mills, each of that are vital for information facilities to run 24/7. Because the AI revolution makes information facilities indispensable, demand for dependable energy programs is predicted to escalate, which might whip up a multi-year tailwind for Caterpillar to trip.

The corporate has already seen development from this development. Its Q2 earnings report confirmed gross sales from its Vitality & Transportation phase up 7% 12 months over 12 months, the one phase to publish greater gross sales. These gross sales netted about $7.8 billion, outpacing Building ($6.2 billion) and Useful resource Industries ($3.1 billion).

Headwinds for Caterpillar, nonetheless, are sturdy. The corporate now expects to lose between $1.5 to $1.8 billion this 12 months to tariff-related bills, whereas stiff competitors with different heavy industrial makers, like Komatsu and Deere & Co, has added stress to its margins. Each of those headwinds are along with the corporate’s regular cyclicality, which implies its income and money circulation can swing wildly with financial cycles, because the chart under illustrates.

CAT information by YCharts.

Nonetheless, this 100-year-old firm has weathered its fair proportion of catastrophic occasions, from the Nice Melancholy to the Nice Recession. With its industrial management and new development from AI spending, Caterpillar presents a uncommon mix of stability and upside proper now.